For many Canadians, paying off debt is the number one priority for achieving financial health. Unfortunately, debt in the form of high interest credit cards, auto loans, and personal lines of credit are difficult to pay off on a fixed budget.

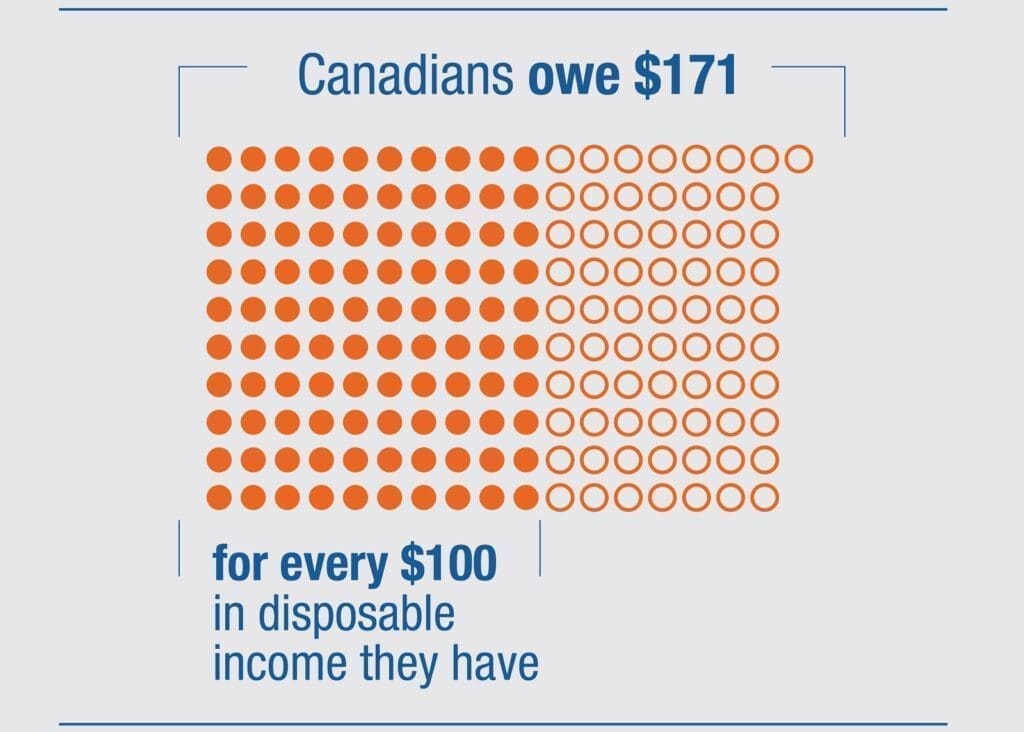

Research shows that Canadian families are facing bigger debt burdens than ever before. Canadian households now owe $171 for every $100 in disposable income. These troubling trends are creating bigger demand for debt consolidation services.

Debt consolidation – the process of combining all your high-interest debt into one monthly payment – is one of the best ways to getting back on the road of financial health. If you’re a homeowner, debt consolidation is even easier because it allows you to combine all your debt into one low-rate mortgage loan. Canada’s housing wealth increased by roughly $200 billion in 2016, giving homeowners enough flexibility to use their property to achieve financial health.

Why consolidate debt?

Debt consolidation is helpful to anyone struggling to make their full monthly payments on time. Homeowners have the option of secured debt consolidation, which allows them to use their property to obtain a bigger loan.

In general, borrowers can get more money at a lower rate through a secured loan because they are pledging some asset (such as their home) as collateral for the loan. With this option, you can:

- Reduce your monthly payments: Combining your debts into your mortgage can actually lower your monthly payment by extending your payback period. Having lower, more manageable payments can help reduce stress and give you a sense of control over your financial situation.

- Simplify your finances: Debt consolidation eliminates the need to keep track of multiple bills with different due dates. It also removes late fees and over-limit charges on credit cards and personal loans. The more straightforward and consistent your payments are, the less likely you’ll be to miss a payment. Having several payments to keep track of makes it far more challenging to pay each one on time each month. A simpler approach is the best way to consolidate debt.

- Reduce your interest rate: Since your debt consolidation loan is backed by a real asset (your home), you will quality for a lower interest rate. These loans are considered less risky in the eyes of the lender, which allows you to obtain more favourable payback options.

- Improve your credit score: Reducing your monthly bills will allow you to make every payment on time. This will boost your credit score over time, giving you even more options in the future. If you have long-term goals that require a loan approval, like moving to a new home or taking out a new auto loan, it is essential that you have a good credit score and a manageable amount of debt.

- Repair credit: Borrowers in financial distress or on the edge of bankruptcy can get back on their feet with a consolidation loan. This allows you to keep your home and remain solvent.

How Homeowner Debt Consolidation Works

Homeowners have several options for managing their high-interest debt. One method is through a debt consolidation loan. As a homeowner, debt consolidation allows you to refinance your existing first mortgage with a debt consolidation mortgage.

A refinance loan allows you to borrow additional money on your mortgage to pay off high-interest debt with a single monthly payment.

Some refinance options allow homeowners to borrow additional money on their mortgage to consolidate unsecured debts. Under this scenario, homeowners borrow additional funds on top of their mortgage, leaving them with one simple monthly payment. These debts don’t become a “separate” mortgage; they are packaged with your existing one to give you one mortgage and one monthly payment.

Although debt consolidation isn’t suitable for everyone, it can translate into big savings under the right circumstances.

While the criteria for obtaining a debt consolidation loan varies based on lender, successful applicants typically have reliable employment income. A steady employment history is also imperative. Homeowners with a higher credit score and no judgments or collections in their credit history will also fare better with low-interest loans.

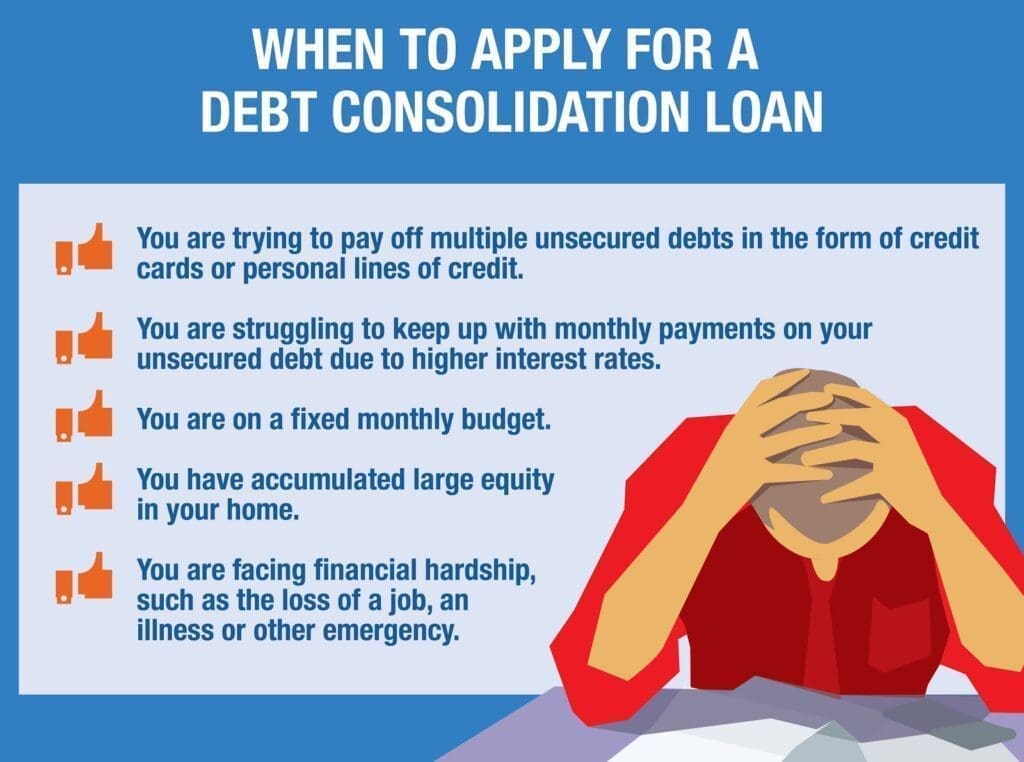

When to Apply for a Debt Consolidation Loan

The point of a debt consolidation loan is to pay down your loans at a lower interest rate. By achieving a lower interest rate, a larger portion of your monthly payment will go to paying down your balance, helping you get out of debt much faster.

Debt consolidation can also lower the amount you pay each month by extending the amount of time you have to pay it back. You should consider applying for a debt consolidation loan for the following reasons:

- You are trying to pay off multiple unsecured debts in the form of credit cards or personal lines of credit.

- You are struggling to keep up with monthly payments on your unsecured debt due to higher interest rates.

- You are on a fixed monthly budget.

- You have accumulated large equity in your home.

- You are facing financial hardship, such as the loss of a job, an illness or other emergency.

- You have tried managing debt payments in other ways, such as downsizing your current lifestyle to cut down your spending, selling some of your assets to finance debt repayments or asking for a loan from trusted friends or family members.

- You have spoken with a financial or debt advisor and determined that debt consolidation is the right choice based on your circumstances.

A homeowner’s guide to the best way to consolidate debt

If you’re an existing homeowner struggling with debt, there are several options available for paying it down once and for all. Below we present several debt consolidation programs. Carefully consider each of them to determine which is best for you.

First mortgage refinancing

Homeowners may choose to refinance their existing mortgage with a debt consolidation mortgage. A debt consolidation mortgage allows you to borrow additional money on your existing mortgage so that you can consolidate other debt into one simple payment at a lower interest rate.

This means the size of your existing mortgage will increase, since you are adding other loans on top of it. However, your overall monthly payment will be lower than it was when you were paying off your other debts individually. This option gives borrowers the flexibility of having to make only one payment each month.

Refinancing allows you to consolidate all other unsecured debts for better terms. It’s like getting a new mortgage and taking the equity on your home at the same time. However, by doing this, you are breaking your existing mortgage contract, which may carry additional service fees and interest payments.

This option is effective for homeowners who know exactly how much money they need. To be eligible for a refinancing loan, you generally need to have at least 20 percent equity in your home. By meeting these criteria, homeowners can borrow up to 80 percent of the appraised value of their home through refinancing. This type of loan give you all the money up front. It also gives you the option of a fixed or variable rate, where interest is charged on the entire loan. This means your monthly payments will go toward a combination of principal and interest. In the case of refinancing, the loan is paid alongside your mortgage.

Refinancing loans are beneficial because you don’t have to go through your existing mortgage lender, allowing you to shop around for the best terms and conditions. The market is highly competitive right now, giving borrowers plenty of options in finding favourable terms. CMI’s Home Refinancing page has more information on how to obtain a refinancing loan on your first mortgage.

Home refinancing is also available through a Home Equity Line of Credit (HELOC), which is added to your existing first mortgage.

Private Home Equity Line of Credit (HELOC)

A HELOC is a line of credit backed by the equity in your home. It allows you to access up to 80 percent of your home’s value, minus your existing mortgage balance. A HELOC is often set up as a mortgage, but is usually added on top of an existing mortgage. This means homeowners pay off their HELOC loan alongside their first mortgage payment. HELOCs are not offered by private lenders, only from major banks, and typically only when doing a refinance.

HELOCs offer both variable and fixed-rate mortgages, depending on the terms of the mortgage. HELOCs are obtained as part of a refinancing loan or through a second position at a fixed rate. It should be noted that most banks or triple-A lenders provide HELOCs on a variable basis.

Since the HELOC is a line of credit, borrowers do not receive all the funds at once, but are free to access as much or as little as they need. This means they don’t have to pay down a portion of the loan principal each month (like in a mortgage). Instead, borrowers pay an interest-only payment based on the amount of the loan they have already used. With a HELOC, homeowners can borrow as much as they need to pay off their other debts.

Since borrowers are free to access as much of the loan as they need, HELOCs ensure you have enough money to pay off all your debt without taking more than you need. They work like credit cards or personal lines of credit, where you receive statements and make monthly payments. As borrowers pay down their HELOC loan, their revolving credit limit increases, allowing them to access more credit as needed. A HELOC can be thought of as any other type of loan, but with a much lower interest rate because it is secured by your property.

Second mortgage

Borrowers with a low credit score or have less than 20 percent equity in their home usually only qualify for a second mortgage. In a second mortgage, borrowers can access up to 80 to 85 percent of the appraised value of their home. However, this depends on location, level of income and quality of the security. The 80 to 85 percent ratio usually applies to real estate in large urban centres. For real estate in rural locations, the ratio is usually capped at around 75 to 80 percent of the home’s value.

(Read: When (and How) to Use Second Mortgages to learn more.)

Much like refinancing loans, second mortgages are paid off along with your existing mortgage, making this option beneficial for borrowers struggling with high credit card debt. It is also a good option for people with good credit who are seeking a cheaper solution to their debt consolidation needs. Homeowners with good credit scores qualify for more attractive rates than those with weaker credit.

Second mortgages: Important considerations

Second mortgages are often seen as a short-term solution until the borrower’s first mortgage matures, which allows them to combine the two together. Until that happens, you will be paying your first and second mortgage at the same time, but if you default on your payments, your home would be liquidated and the first mortgage will be paid before the second mortgage.

It’s also important to note that second mortgages aren’t available in every region, especially since they are usually funded by private lenders. Many second mortgage lenders (also referred to as private lenders in many cases) offer second mortgages in major urban centres across Canada.

That’s because the property is also evaluated along with the potential borrower, which makes it more difficult, but not impossible, for rural areas to qualify for this type of financing. CMI’s private mortgages page provides more information on private lender financing.

Since private loans are uninsured, the lender uses the property as collateral. For this reason, private lenders typically offer a lower loan-to-value (LTV). That is, you need more equity in your home.

Homeowners also have the option of taking out a home equity loan. Home equity loans typically have fixed interest rates, as opposed to equity lines of credit, which offer adjustable rate loans.

Although the prospect of additional credit or a lump sum of cash from a second mortgage may seem like a great way to pay off existing debts and credit lines, it’s important to consider all the financial implications. This is why it’s so important to partner with a mortgage professional who can assess your specific situation and provide you with the best lending options.

Blended mortgage

Blended mortgages allow homeowners to take advantage of low interest rates without paying the penalties of breaking their existing mortgage. This essentially allows homeowners to ‘blend’ their mortgage. Rather than breaking their existing mortgage, homeowners can decide to keep it in the new blended rate. This allows them to avoid all the penalties associated with a typical refinance.

Although this option isn’t available everywhere, it may be attractive for borrowers with a good amount of equity in their home and whose property has increased in value. In this scenario, homeowners can get up to 80 percent of their home’s appraised value in cash. This can quite easily add up to hundreds of thousands of dollars in funding, and end up being significantly more than the amount you currently have on your first mortgage.

It’s also important to note that blended mortgages carry a penalty in the form of higher interest rates. The penalty is “blended” in the form of a premium rate, since the borrower is usually getting a non-triple A bought-down interest rate. Although this may be a suitable option for borrowers with low equity, homeowners with higher equity may find it more useful to break their existing mortgage, pay the penalty and enter a new mortgage with more favourable terms.

A blended mortgage is used to access equity and is paid out as a lump sum. It can also be used to lower an existing mortgage rate through both variable and fixed options. Much like a regular mortgage, payments on a blended mortgage go toward both principal and interest.

Understanding break costs

Break costs are the fees or penalties associated with breaking your existing mortgage before the end of its term. Break costs apply to homeowners that choose to refinance their mortgages or obtain a HELOC before their existing mortgage term ends. Break costs compromise the following:

- Legal fees ($800 – $1,000)

- Discharge fee (up to $200)

- Appraisal fee ($250)

- Early payout fee (three months’ interest)

The extent of these fees will depend on several factors, including the lender, existing interest rates and the type of deal you are pursuing. That’s why it’s important to work with a mortgage broker who can guide you through the process.

How to make debt consolidation work for you

For all its benefits, debt consolidation also carries risks that homeowners must carefully weigh before going down this route. The first risk is losing your home in the event you default on your debt consolidation loan.

If you don’t do your due diligence and shop around for the best services, you could also end up paying much higher fees. To avoid these risks, it is imperative to make all your payments on time. This applies to both the consolidation loan and any other unsecured debt you currently have. In the case of a debt consolidation loan, a failure pay back your loan on time could result in a default. Click here to learn about how to create a monthly budget.

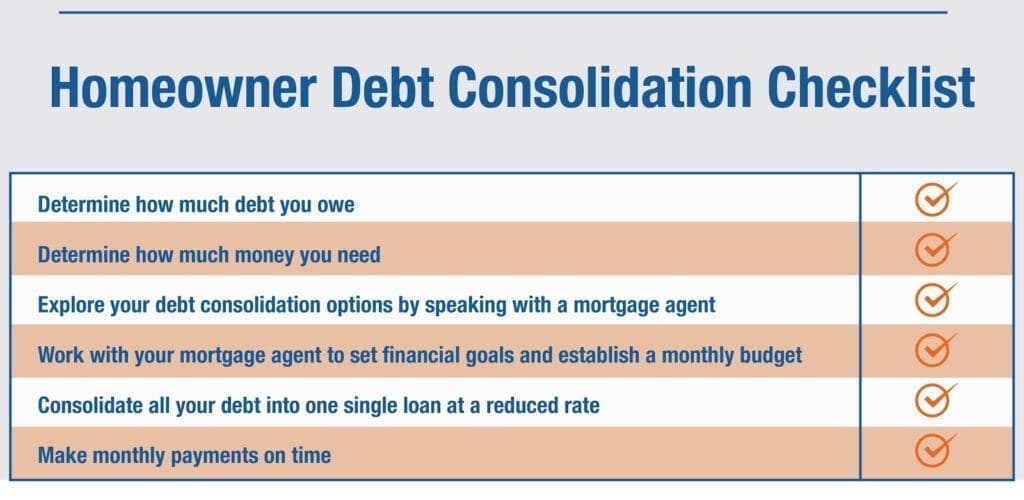

Consolidating your high interest debt into one manageable loan doesn’t have to be complicated. It does require careful planning and the help of a qualified mortgage professional. Determining whether a debt consolidation loan is right for you depends on several criteria. Some of the most important include your financial goals, credit score, and the amount of equity available in your home.

Before pursuing a consolidation loan, borrowers should consider creating a budget to get into the habit of spending less than they earn. While a debt consolidation loan can assist you in aching your financial goals, long-term financial health requires better management of personal finances.

Leveraging the equity or value in your home to consolidate your debt is a large undertaking, and it’s not something to be taken lightly. Regardless of the best way to consolidate debt you’re considering, be sure to do your research. Look for informative resources online, ask a loved one about their experience with debt consolidation, calculate costs to determine whether it’s is the right choice and seek assistance from a mortgage professional.

The more informed you are about debt consolidation, the more likely you will be to succeed in paying off your debt.