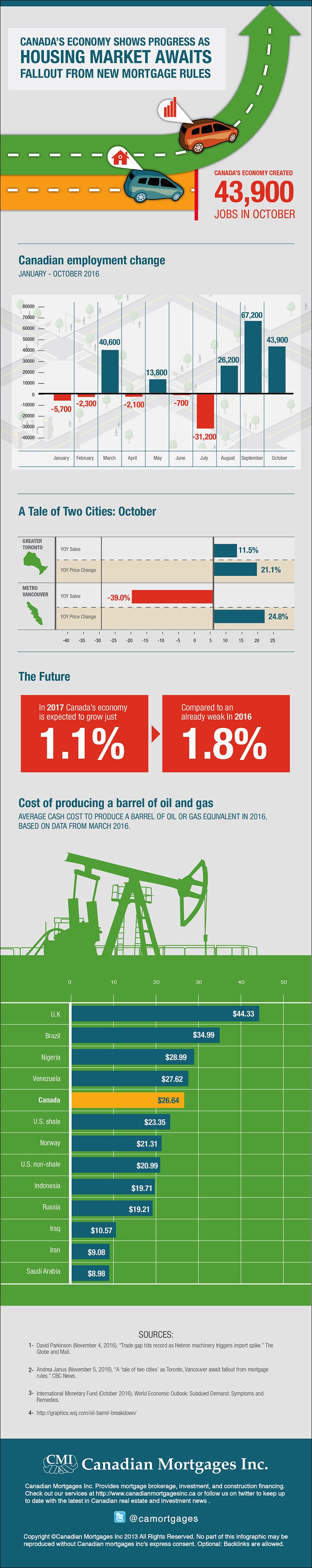

Canada’s economy created 43,900 jobs in October, marking the first back-to-back gains in employment in over a year. On the housing front, real estate sales are diverging between East and West, as markets await the fallout from Ottawa’s new mortgage rules.

Mixed Economic Cues

The nearly 44,000-strong jobs number in October marked the third consecutive month payrolls increased. The gains were mostly driven by a surge of 67,000 part-time jobs. Full-time employment declined by 23,000. Meanwhile, self-employment rose by 50,100. The unemployment rate held steady at 7%, as more people began searching for work.

A solid employment report helped offset another month of weak exports, as soft international demand continued to weigh on the manufacturing sector. The Canadian dollar recently slumped to an eight-month low against the greenback, but even this hasn’t helped spur international sales. As a result, Ottawa posted its biggest-ever trade deficit of $4.08 billion in September, compared to a $1.99 billion shortfall the previous month. The deficit was largely attributed to a huge shipment of machinery from the Hebron offshore oil project.[1]

The Housing Market

Canada’s ‘tale of two cities’ housing market was on full display last month, as home sales in Toronto skyrocketed 11.5% while Vancouver saw its sales plummet nearly 39%. The average selling price for a Toronto region home is up a staggering 21.1% to $762,975. The average sales price in Metro Vancouver rose 24.8% to $919,000.

Vancouver is in a “full-blown correction,” according to David Madani of Capital Economics.[2] Sales in the region have been declining steadily since February, with the correction accelerating over the summer after the BC government introduced a 15% foreign buyer tax on Metro Vancouver. Experts have warned that the tax will simply make Vancouver’s affordability crisis a Toronto one, as foreign investors take their money east. Toronto has so far made no plans to introduce a similar measure limiting foreign capital.

Experts are still waiting for the market’s reaction to Ottawa’s new mortgage guidelines, which were implement just last month. The new, stricter terms are meant to curb systemic risk from a market that is becoming increasingly reliant on cheap credit. While the Bank of Canada may want to raise interest rates to help re-balance the market, a rate hike is nowhere on the horizon given the country’s weak economic outlook.

The Future

Canada’s economic struggles are expected to continue in 2017, with the International Monetary Fund (IMF) forecasting even weaker growth than the past three years. Canada’s economy is expected to grow just 1.1% in 2017, compared to an already weak 1.8% in 2016. By comparison, advanced economies as a whole are forecast to grow 3.1% this year and 3.4% next year.[3]

Canada’s prospects are tied to developments south of the border, and this partly explains the country’s weak performance. Oil-price uncertainty is also taking its toll even after one-off events such as the Alberta wildfires.

Oil prices plunged more than 10% last week and could fall even further should the Organization of the Petroleum Exporting Countries (OPEC) fail to implement a production freeze this month. The 14-member cartel will hold its biannual meeting in Vienna November 30 to discuss output quotas. Canadian investors will be keenly monitoring the events for clues about the market’s direction.

References

[1] David Parkinson (November 4, 2016). “Trade gap hits record as Hebron machinery triggers import spike.” The Globe and Mail.

[2] Andrea Janus (November 5, 2016). “A ‘tale of two cities’ as Toronto, Vancouver await fallout from mortgage rules.” CBC News.

[3] International Monetary Fund (October 2016). World Economic Outlook: Subdued Demand: Symptoms and Remedies.