The US Federal Reserve will conclude its fifth Federal Open Market Committee (FOMC) meeting of the year on July 31. Although the market isn’t expecting a change in policy at this meeting, the Fed’s communications should set the stage for a September rate cut.

For the Federal Reserve to begin cutting rates, it is crucial that inflation, as measured by the Personal Consumption Expenditures (PCE) deflator, moves closer to the Fed’s 2% target. Data released last week show that PCE inflation fell to 2.5% year-over-year in June, down from 2.6% in May and significantly lower than its peak of 7.1% in June 2022. On a three-month annualized basis, core inflation is running at just 2.3% – barely above the Fed’s long-run target.

Speaking at The Economic Club of Washington, D.C., just two weeks ago, Fed Chair Powell highlighted why the Fed would not and should not wait for inflation to hit 2% before deciding to cut interest rates. Higher-frequency data suggest that, after staying at 2.5% year-over-year in July, inflation could resume its decline over the rest of the summer, potentially touching the Fed’s 2% year-over-year target as early as September.

Last week’s initial estimate of second quarter U.S. GDP growth jumped well above consensus expectations to a 2.8% annualized rate, up from a soft 1.4% in the first quarter. If the first-quarter real GDP reading of 1.4% understated economic momentum due to a sharp reduction in inventory growth, the second-quarter number suffered from the opposite challenge: an acceleration in inventory accumulation. A clearer picture emerges from the path of real final sales, which excludes inventories: real growth was 3.5% for the year ending in the fourth quarter, but it slowed to 1.8% annualized in the first quarter of 2024 and 2.0% in the second quarter.

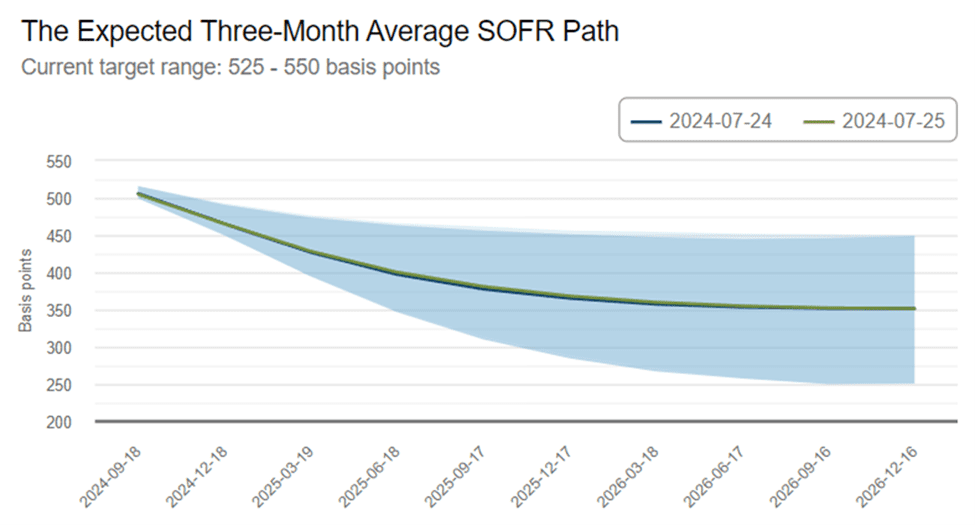

A sturdy second quarter and first half GDP growth performance does little to change the view for the US economy. Financial markets and most economists still anticipate that the Federal Reserve will cut the federal funds rate by 25 basis points following the September 17-18 FOMC meeting. There is ongoing debate over whether restrictive monetary policy operates with a “long and variable” lag, potentially necessitating further rate cuts later this year to prevent a recession in late 2024 or 2025. The market, however, anticipates more rate cuts within the year. According to the Atlanta Fed’s Market Probability Tracker, the expected three-month Fed Funds rate by year-end is 3.57% (with a range of 2.67% to 4.47%).

Source: Federal Reserve Bank of Atlanta

Housing Affordability Watch

CMI monitors the latest developments and offers insights on solutions to Canada’s housing affordability crisis

CMHC’s securitization efforts through NHA Mortgage-Backed Securities and Canada Mortgage Bonds are crucial for market efficiency and competitiveness. However, restrictions on mortgage insurance eligibility have created challenges for securitization, as mortgages must be insured to qualify.

In the latest Housing Affordability Watch, we explore innovative approaches to address these challenges, including synthetic risk transfer mechanisms. These tools, already used by US agencies and European banks, could mitigate CMHC’s credit risk while fostering a deeper mortgage securitization market in Canada.

To understand how these strategies could reshape Canada’s housing market and align with CMHC’s objectives, read the full post: Why CMHC Should Explore Synthetic Risk Transfer for Mortgage Securitization

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.