The Federal Open Market Committee (FOMC), the policy-setting body of the Federal Reserve, cut policy rates by 50 basis points, lowering the target range for the fed funds rate to 4.75 per cent to 5 per cent. I was surprised to see such a significant cut, as it risks signalling that the Fed is concerned about a weakening economy.

It was clear in the policy statement that the Committee determined inflation had eased enough and the labour market had deteriorated sufficiently to warrant a bigger rate cut. The statement noted: “The Committee has gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance.” In contrast, the July statement reflected a lack of confidence and indicated the risks were only moving into balance. The new statement also emphasized “[t]he Committee is strongly committed to supporting maximum employment and returning inflation to its 2 per cent objective.”

Forward guidance from July’s statement was reiterated: “In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks.”

Governor Bowman dissented, advocating for a 25 basis point cut. She expressed concern that inflation remains about the 2 per cent target and worried that the public would misinterpret the large move as “a premature declaration of victory.” Moving at a measured pace towards a more neutral policy stance would “avoid unnecessarily stoking demand.” Very seldomly do we see a Fed governor break with the 11 other voting members. The last time this happened was in 2005.

As part of the Fed’s announcement, it provided a Summary of Economic Projections (SEP), which included a ‘dot plot’ showing the median projection among FOMC members. Unlike the Bank of Canada, the Fed shows the full distribution of member projections. This dot plot indicates that more cuts are expected. The median FOMC projection is for an additional 50 basis points in cuts this year, bringing the range midpoint to 4.375 per cent, followed by 100 basis points next year to 3.375 per cent, and 50 basis points in 2026 to 2.875 per cent.

This latter figure represents the new, higher longer run or neutral level, which was lifted by 12.5 basis points from its previous estimate. Interestingly, 10 participants projected at least 100 basis points of cumulative rate cuts (with one projecting 125 basis points), while nine forecasted 75 basis points or less, including two calling for no further action.

In the press conference, Fed Chair Powell stated that policy was not on a “preset course” and would be decided on a “meeting-by-meeting” basis. This likely means that policy moves going forward will occur in 25 basis point increments.

For the mortgage market, the question is whether we will see easing in bond yields. Two factors are at play in the bond market. The first, often overlooked but important for day-to-day liquidity, is quantitative tightening. Currently, the Fed is allowing up to $25 billion per month in Treasuries and $35 billion per month in mortgage bonds to mature without replacement, down from the previous pace of $60 billion per month in Treasuries as of June 1, 2024. This slower balance sheet runoff improves market liquidity and appears to be supporting the market without causing disruptions.

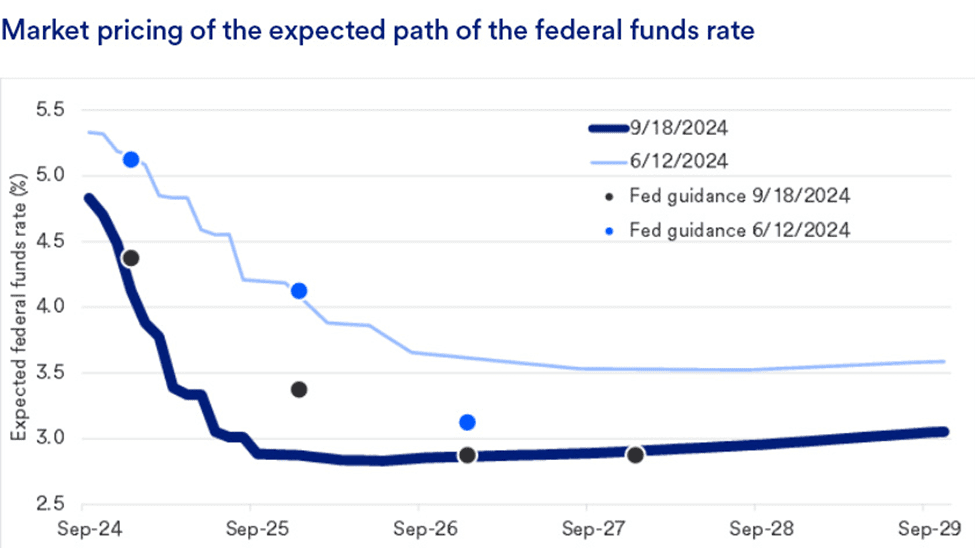

The second factor is market expectations. When the Fed announced its policy decision, Treasury bond yields were relatively unchanged, as the bond market had already begun to incorporate expectations for rapid rate cuts in coming months. Moreover, as we can see from the chart below, the market and the Fed seem to have similar expectations.

Source: U.S. Bank Asset Management Group Research, Federal Reserve, Bloomberg; 6/12/2024-9/18/2024.

For now, this suggests we shouldn’t see major changes in the yield curve based on rate expectations. However, this will change as new data becomes available.

Housing Affordability Watch

CMI monitors the latest developments and offers insights on solutions to Canada’s housing affordability crisis

Inflation is back at 2% for the first time in over three years, but the housing component remains stubbornly high. With third-quarter growth expected to miss forecasts, could the Bank of Canada take more aggressive action on rate cuts?

Check out our latest Housing Affordability Watch post for an analysis of current inflation trends, housing costs, and their implications for interest rates. Read it here: Is It Time to Lower Rates More Aggressively?

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.