Canadian housing market patterns remained subdued in July as the interest rate cut at the end of the month did little to encourage buyers back into the market.

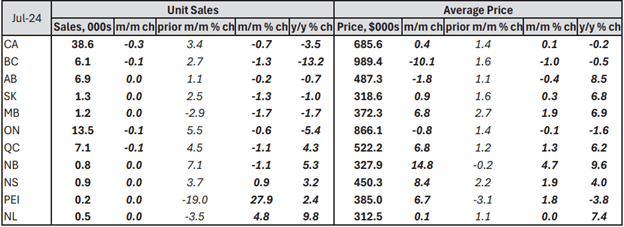

MLS home sales held steady in July, according to the latest data from the Canadian Real Estate Association (CREA). Total sales slipped 0.7% month-over-month and 3.5% year-over-year to a seasonally-adjusted 38,600 units. Sales have remained within a narrow range for more than a year. While there are plenty of prospective homebuyers, driven by high levels of immigration, normal household formation, and those looking to move up the housing ladder, affordability continues to constrain sales volume. High mortgage rates and the spike in prices during the pandemic have created challenging financing and downpayment conditions.

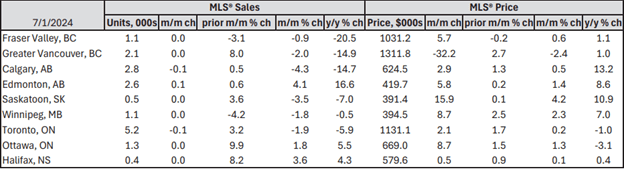

Sales declined across most regions, with seven of ten provinces reporting fewer transactions. The steepest monthly declines were in Manitoba (-1.7%), Saskatchewan (-1.3%) and BC (-1.3%). In contrast, sales jumped in PEI (27.9%) and Newfoundland and Labrador (4.8%), rebounding from June declines. Generally, the Prairies and Atlantic markets saw more robust sale trends due to affordable housing availability and strong interprovincial migration. At the metro level, Calgary (-4.3%), Saskatoon (-3.5%), and Greater Vancouver (-2.0%) experienced more significant declines.

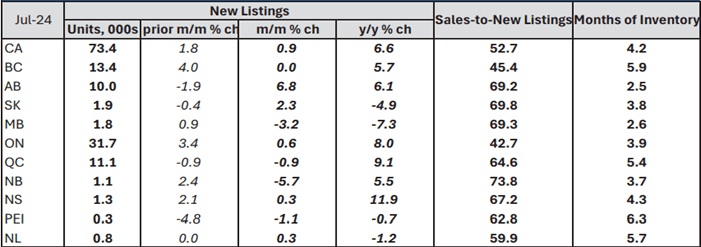

In July, the average price held steady at $685,600, edging up just 0.1% from June and down 0.2% year-over-year. The trend has been positive in recent months, though only slightly. While rising new listings (up 6.6% year-over-year) suggest a potential softening in market conditions, the ratio of sales-to-listings remains consistent with a balanced market. Price resilience continues to be a key theme, as sellers are unwilling to lower prices due to strong latent demand on the sidelines.

Average prices varied across the provinces. Prices declined in B.C. (-1.0%) and Alberta (-0.4 per cent), while they remained flat or increased in all other provinces. Prices are still sharply higher on a year-over-year basis in most provinces outside BC and Ontario. This trend is also playing out in the metro markets, with significant price growth in Saskatoon (4.2%) and Winnipeg (2.3%). Year-over-year, prices rose by 13% in Calgary and 11% in Saskatoon, while they remained relatively flat in both Greater Vancouver (1.0%) and Toronto (-1.0%).

Sales volumes are expected to pick up in the last few months of 2024 and throughout 2025 as declining mortgage rates draw more buyers into the market. However, sales growth will be tempered by low affordability. As sales pick up and housing supply lags demand, moderate upward price pressure is expected.

MLS – Housing Summary

MLS – Housing Supply

MLS – Housing Summary, Select Metro Markets

Source: Canadian Real Estate Association (CREA)

Housing Affordability Watch

CMI monitors the latest developments and offers insights on solutions to Canada’s housing affordability crisis

Curious about the state of new rental housing in Canada? The latest Housing Affordability Watch delves into the complexities of the condominium development process, highlighting the significant risks and challenges developers face, especially in today’s volatile economic climate. From land assembly to occupancy, each phase of development is fraught with obstacles, including rising construction costs, supply chain disruptions, and escalating interest rates. The article also touches on the legal protections in place for buyers and explores the implications of insolvency on distressed projects. Discover why the condo market’s future remains uncertain, and what that means for the broader housing landscape. Read the full article here: Cracks in the Foundation – Examining the Condo Development Model

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.