It seems safe to assume that we have seen the last of interest rate hikes in the policy cycle. Both Governor Macklem and Fed Governor Powell have indicated that rates are sufficiently high.

Market watchers are now focusing on when and how quickly the Federal Reserve and the Bank of Canada will begin lowering interest rates. While the market was initially overly optimistic in its views, the current expectation is for cuts to begin in September, with three cuts totaling 75 basis points by the end of the year.

While the focus is on the timing of the cuts, the more fundamental question is how much easing we will see in this phase of the policy cycle. Central banks routinely evaluate the neutral rate of interest as part of their policy framework. This rate, also known as the long-run equilibrium rate, the natural rate, or r-star among economists, represents the short-term interest rate that would exist under conditions of full employment and stable inflation. It is the rate at which monetary policy neither stimulates (expansionary) nor restricts (contractionary) economic activity.

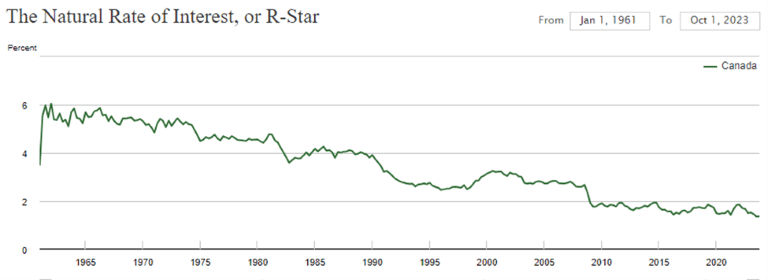

According to estimates from Kathryn Holston, Thomas Laubach, and John C. Williams of the Federal Bank of New York, the neutral rate in Canada has been decreasing since 1968, by about 3.6 percentage points. This trend is similar for other advanced economies.

Source: Federal Reserve Bank of New York

In the long run, the neutral rate of interest is determined by the supply and demand for savings. Total investment in the economy must be equal to the pool of available capital or savings. For this to happen, interest rates need to be high enough to convince savers to save and low enough to incentivize borrowers to borrow.

Over time there are several factors that can affect the supply and demand for savings:

- Productivity growth – Higher productivity growth is generally associated with new investment opportunities that increase the demand for capital, driving up rates. In recent years, productivity growth has been very low, driving down the neutral rate.

- Demographics – One significant motivation for savings is to prepare for retirement. Researchers have shown that demographic trends, such as aging populations and declining fertility rates, have had a large downward effect on rates in advanced economies.

- Global saving glut – as the world becomes more connected, the pool of available savings becomes more global, making domestic interest rates more sensitive to global capital flows. The theory contends that in the early 2000s, the export-oriented policies of emerging market economies flooded capital markets with increased supply of global savings.

The Bank of Canada maintains its view that the neutral rate of interest is between 2-3%. Over the past 15 years, economists generally believed the neutral rate to be around 2.5%. However, the overnight rate, which can fluctuate significantly based on policy decisions, averaged approximately 1% from 2010 to 2020. During this period, inflation tended to remain below the 2% target due to concerns about deflation, influenced by factors such as globalization, demographic shifts, and automation, which kept downward pressure on prices. The slow recovery from the Financial Crisis prompted central banks to maintain an accommodative policy stance for an extended period. As a result, real yields (adjusted for inflation) were often negative during this time, and in some cases, nominal yields (unadjusted) were negative as well.

In the early 2000s, Canada’s inflation rate typically hovered slightly above the 2% target, while the overnight rate stood at around 3.5%. Maintaining a positive real yield was crucial to anchor inflation around the 2% target.

Current inflationary pressures, while declining, are not fully subdued. Central banks will likely keep overnight rates above the inflation rate. Given central banks’ focus on policy credibility, expect that, barring a deep recession, policy actions will be cautious. Central banks were caught flat footed in thinking that this inflationary cycle would be short-lived. Consequently, they will proceed cautiously as they analyze how changes in the supply chain, geopolitical pressures, productivity, and immigration shape the outlook for future price dynamics. Understanding the Bank of Canada’s response to these factors will be crucial in gauging how low interest rates may fall.

Housing Affordability Watch

CMI monitors the latest developments and offers insights on solutions to Canada’s housing affordability crisis

A recent report by Ontario’s Municipal Property Assessment Corporation (MPAC) underscores the alarming scarcity of homes priced under $500,000 in Ontario, with just 19% of properties falling below this threshold compared to 74% in 2013. The challenge is particularly daunting for first-time buyers. One promising avenue for increasing affordability lies in the development of properties on leased land, a model already seeing success in some parts of Vancouver. However, despite potential benefits, awareness and financing obstacles persist. The federal government can play a major role in delivering this kind of housing, with key support from the provinces and local municipal governments.

Read the full post to find out how: Lowering the First Rung on the Housing Ladder

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.