Much of understanding central bankers is interpreting changes in their policy statements. As expected, the Federal Reserve (the Fed) left its policy rate unchanged and maintained the current pace of quantitative tightening in its January meeting.

The Federal Open Market Committee (FOMC), however, made significant changes to the policy statement, suggesting an upward revision in its economic forecast and a shift away from a tightening bias are on the horizon. It also removed a paragraph from its previous statement about risks to the banking system.

The Fed’s preferred inflation measure, the Personal Consumption Expenditures (PCE) index, stands at 2.9%, with the three-month and six-month annualized pace now at 2%. Despite these figures, the Fed made it clear it is not comfortable reducing the policy rate until it is confident it is nearing the 2%inflation target. This suggests the Fed prefers to delay the first rate cut until June.

Although the Fed did not signal any change to the pace of quantitative tightening, we anticipate a potential slowdown in the speed of balance sheet reductions, starting with its May meeting.

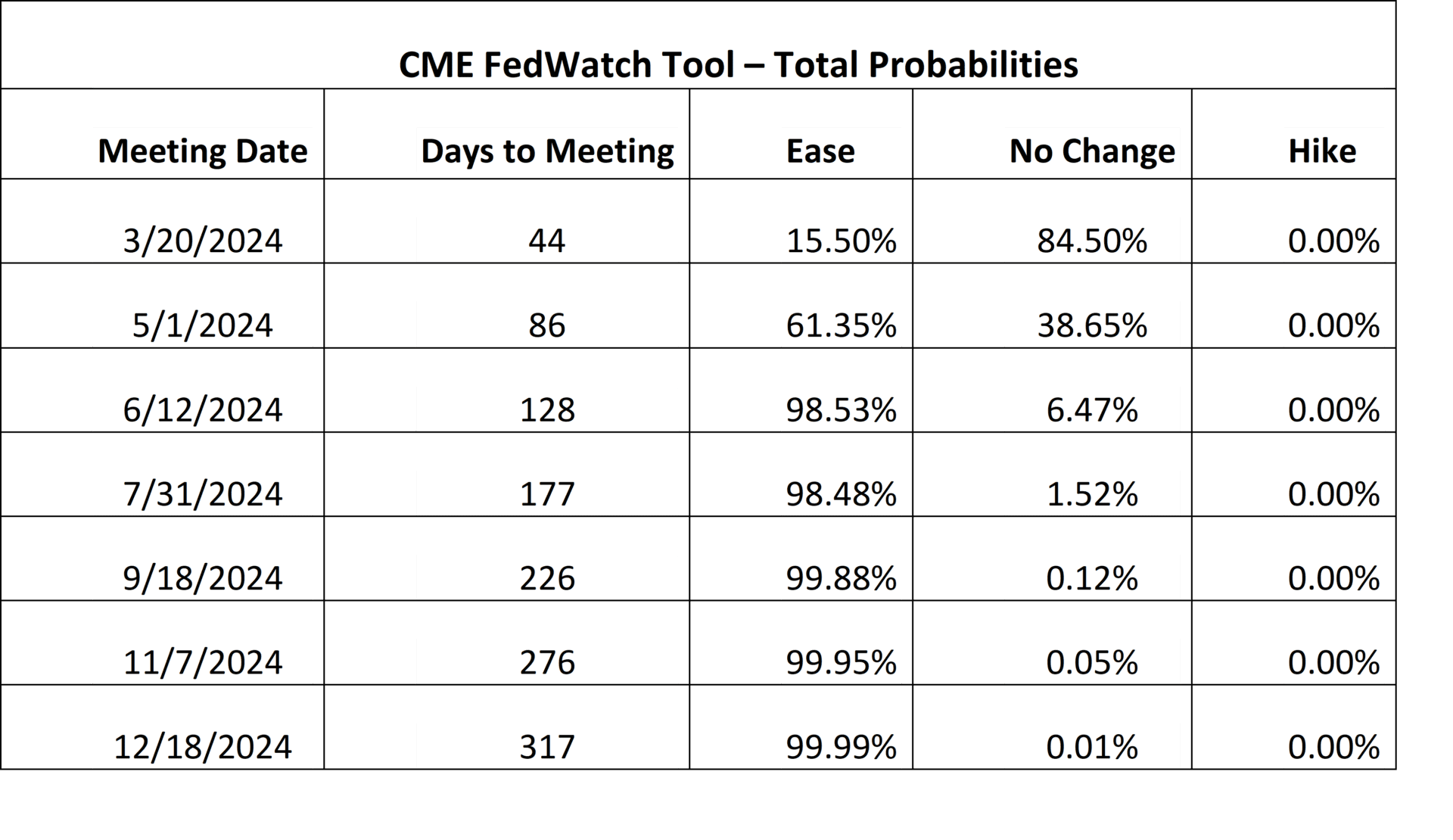

Based on CME’s FedWatch Tool, current market expectations align with our thinking:

Source: CME Group

Source: CME Group

The strength of the labour market supports the Fed Chairman’s note that there is unlikely to be a rate cut in March. In January, the U.S. economy added 353,000 new jobs, with a significant upward revision from 21,000 in December to 333,000. Job gains were spread across major sectors, particularly in higher-paying fields, contributing to the 0.6% monthly increase in average hourly earnings and a 4.5% annual rise. The American unemployment rate has remained below 4% for 24 consecutive months, something that hasn’t been seen since 1967.

We are comfortable with our call for the Fed to begin easing rates in June, acknowledging the possibility of a cut in May based on the evolution of inflation data. We expect that the Fed’s preferred inflation variable, the Personal Consumption Expenditures (PCE), will be at or near the 2% target by the May meeting.

Housing Affordability Watch

CMI monitors the latest developments and offers insights on solutions to Canada’s housing affordability crisis

Over the past 40 years, cities have mitigated the financial risk of infrastructure projects by relying on development charges for funding, aligning with the mindset that “growth should pay for growth. While benefiting existing property owners with lower property taxes, this approach introduces a number of inefficiencies.

The latest instalment in our Housing Affordability Watch explores alternatives and examines how financing infrastructure more efficiently can help to improve housing affordability.

For a deeper look at these proposals and their implications, read the full article here.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.