At the House of Commons Standing Committee on Finance on October 30th, Bank of Canada governor Tiff Macklem said the decision to hold rates was driven by the anticipated economic impact of upcoming mortgage renewals. Macklem explained that the effect of previous rate hikes is still filtering through the economy, including through mortgage renewals, and the central bank anticipates weaker growth as a result.

As more Canadians renew their mortgages at higher rates, households are expected to experience financial strain, resulting in a slowdown in the economy. Macklem said the Bank of Canada wants to avoid a recession, but slower growth is necessary to fight inflation.

The most recent jobs numbers support the central bank’s decision to stand pat on rates. Employment rose by 17,500 in October, which was below the 22,500 net jobs gain analysts had forecasted. In addition to a decrease in full-time jobs, the key takeaways from the October employment report were a slowdown in wage increases, unchanged working hours, and most importantly, a rise in the unemployment rate to 5.7%, up by 0.2 points.

The jobless rate is now 0.8 points above the low of 5.5% reached last summer. With the population growing at 50,000 per month, the modest rise of 17,500 jobs is not enough to prevent the unemployment rate from climbing. This slowdown in the job market is expected to affect wage growth, although not as quickly as desired by the Bank of Canada. Additionally, with a stagnant GDP figure for August and an estimated unchanged reading for September, the economy seems to be heading towards a second consecutive negative quarterly GDP reading.

While the Bank of Canada has maintained its position on interest rates, until there is a clear path to achieving a core inflation rate of 2%, the Bank will leave the prospect open for another increase in the overnight rate.

Concern over rise in negative amortization mortgages

On October 30th, the Bank also highlighted concern over negatively amortizing mortgages. Negative amortization occurs when a borrower’s monthly mortgage payment is less than the interest due on the loan and the outstanding mortgage balance grows over time rather than declining. This phenomenon is mostly associated with variable rate mortgages.

Those who bought or refinanced homes during the pandemic, when interest rates were at their lowest, heavily opted for variable rate mortgages (VRMs). In Canada, most VRMs come with fixed payments, where the interest portion is determined by the prevailing prime lending rate, while the rest is used to repay the principal. As a result, the Bank of Canada’s series of rate hikes – from 0.25% to 5% – has propelled growth in negative amortization mortgages with terms exceeding 30 years.

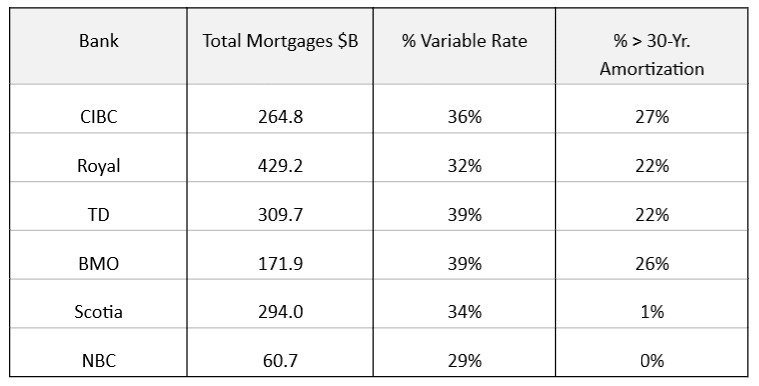

As of July 31, negative amortization mortgages were 24% of total mortgage portfolios (insured and uninsured) for BMO, CIBC, Royal and TD. This is equivalent to $277 billion in mortgages – up from virtually nil a year ago. National and Scotia mainly offer adjustable-rate mortgages – as rates change the mortgage payment changes to keep the amortization period fixed – so both banks have negligible exposure to negative amortization within their mortgage portfolios.

Variable Rate Exposure (as of July 31, 2023)

Source: Fitch Ratings

Canada’s banking regulator, the Office of the Superintendent of Financial Institutions (OFSI), has announced regulatory changes to address risks related to mortgages in negative amortization. Effective early next year, banks will be required to maintain a higher amount of capital, reflecting the elevated risk associated with mortgages in negative amortization when the loan-to-value ratio (LTV) surpasses 65% (i.e. when the outstanding mortgage balance is 65% or more of the value of the underlying property). The proposed changes are designed to incentivize banks to reduce the volume of mortgages that could potentially go into negative amortization.

Mortgage repayment trends

To assess how borrowers are reacting to the increase in rates, the prepayment report for floating rate 5-year mortgage-backed securities (MBS) pools, published by CMHC, serves as a valuable tool. Although it doesn’t pinpoint individual issuers, the report offers a comprehensive look at trends within the banks’ variable-rate mortgage (VRM) portfolio.

Report data indicates that borrowers with VRMs have been effectively managing impacts of rising rates by making partial principal payments or transitioning to fixed-rate mortgages. Enforcement activity, which is undertaken when a borrower is unable to make mortgage payments, has been minimal, which suggests that despite the rise in rates, defaults have remained low.

Also, the majority of non-amortizing mortgages, where payments are covering interest only, were recorded between November 2022 and February 2023. This is a positive sign that banks have taken measures to limit the growth of these mortgages.

One caution is around borrowers whose mortgage rates have exceeded the trigger point – that is, the rate at which the regular payment is no longer enough to cover the full amount of interest accrued since the last payment. These borrowers might encounter payment shock when their loans mature and are re-underwritten based on the original amortization but at higher rates and with larger principal amounts. Those who were first-time homebuyers with high loan-to-value ratios, purchasing at or close to peak prices in 2020 or 2021, could face significant challenges during renewal, particularly if their equity position has been significantly eroded. Similar to Fitch, we anticipate that delinquency rates will not rise in 2024, remaining within the expected range of 0.2-0.25%.

Housing Affordability Watch

CMI monitors the latest developments and offers insights on solutions to Canada’s housing affordability crisis

Studying past housing policies can provide valuable insight into potential solutions for the current housing crisis. In our latest Housing Affordability Watch, Looking Back to See the Way Forward – Part 2, we continue our examination of Canada’s significant change in approach to housing policy throughout the 1970s – another period when affordability concerns and rental market pressures captured public attention. Learn how tax reforms during this period contributed to current market conditions and the associated policy implications.

If you missed it, you can find part one here: Looking Back to See the Way Forward – Part 1.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.