Condo units under construction are at an all-time high, yet, pre-sales in Toronto are running at a 27-year low. After years of steady price increases, investors are beginning to question whether this is a viable near-term market. A recent Globe and Mail article suggests that investors are fleeing the preconstruction market.

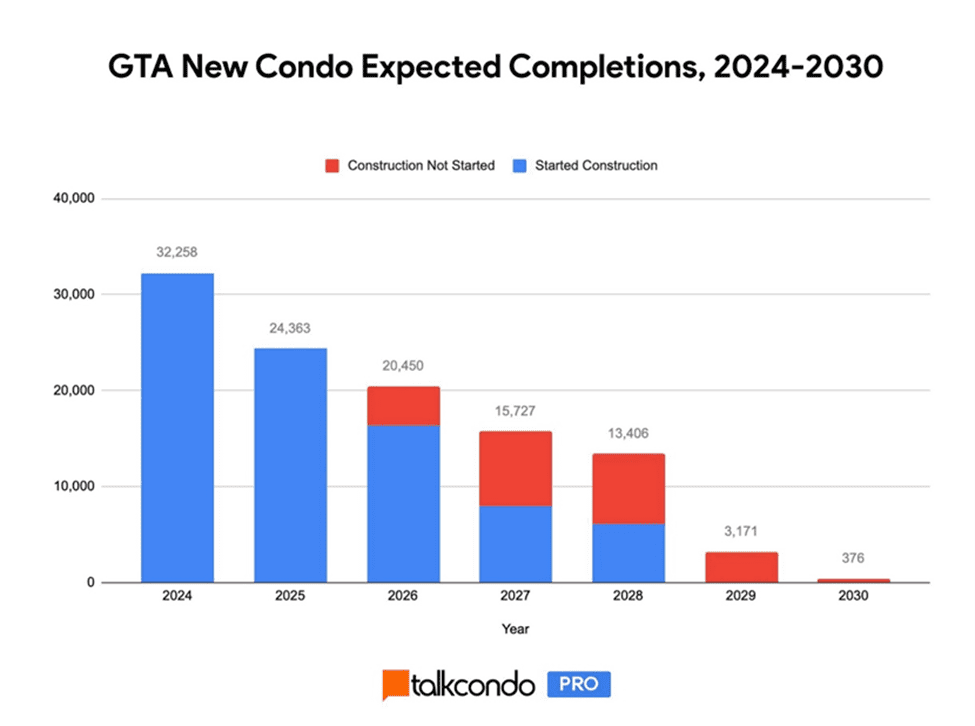

Toronto real estate brokerage TalkCondo has highlighted that, based on current projections, new condo completions in the GTA are expected to come to a near standstill by 2030.

Source: TalkCondo

The recent move by the federal government to increase mortgage insurance limits is a step toward stabilizing the condo market, but is it enough? We’ve previously suggested that the government could consider introducing a zero-down payment mortgage as one potential solution.

Another option is to address the housing development process itself. Even with rates starting to move lower, commercial lenders are growing more cautious about lending to condo developers, a situation reminiscent of the aftermath of the 2008 financial crisis.

To counter these pressures on the condo market, CMHC formally introduced multi-unit condo construction mortgage insurance in 2010. While CMHC had provided this insurance on a case-by-case basis in prior years, the program gained traction after the financial crisis. In 2008, the insurance in force under this program stood at $1.55 billion, peaking at nearly $1.6 billion in 2009.

In 2010, CMHC published advice to issuers on the multi-unit condo construction mortgage insurance program. The key program features were:

- Available for the construction of new condominium buildings

- Loan-to-cost of up to 85% based on presales

- Sources of equity could be in the form of cash, subordinated debt or land value

- Limited non-residential space permitted

In an April 2009 letter to BILD (a group representing GTA developers), the former CEO of CMHC noted, “CMHC has seen a sharp increase in interest by borrowers and lenders to obtain insured condominium construction financing.” From just 630 condominium units insured across the country in 2005, the number grew to over 3,400 units in 2007 and nearly 5,200 units in 2008. By April 2009, CMHC had discussions on projects representing a potential 4,500 new condominium units.

The letter further noted that, in the wake of the financial crisis and recession, fewer lenders were willing to finance condo construction. This program naturally tapered as the market improved and was dropped in 2014 when the government tightened the scope of mortgage insurance coverage.

Currently, the government is focused on supporting the purchase of new condo units, which will help to clear the inventory backlog and, over time, encourage lenders to support new condo projects. However, this will take years to fully resolve. An alternative would be to reintroduce CMHC’s condo construction mortgage insurance program, which would help bridge the funding gap and prevent the pipeline of new units from drying up.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.