Highlights

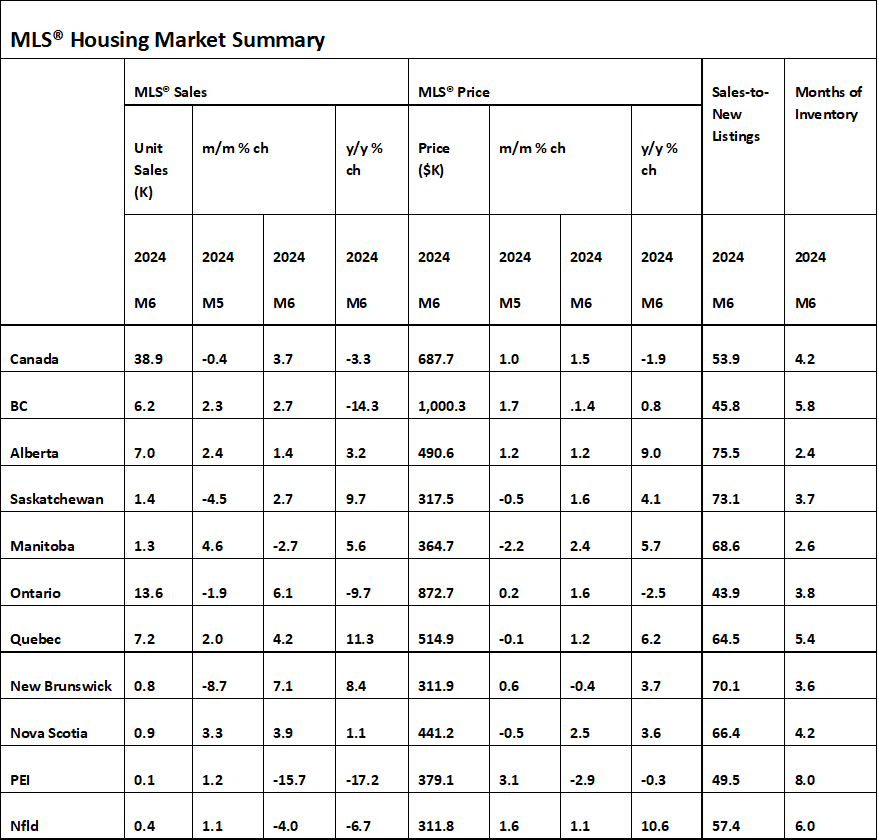

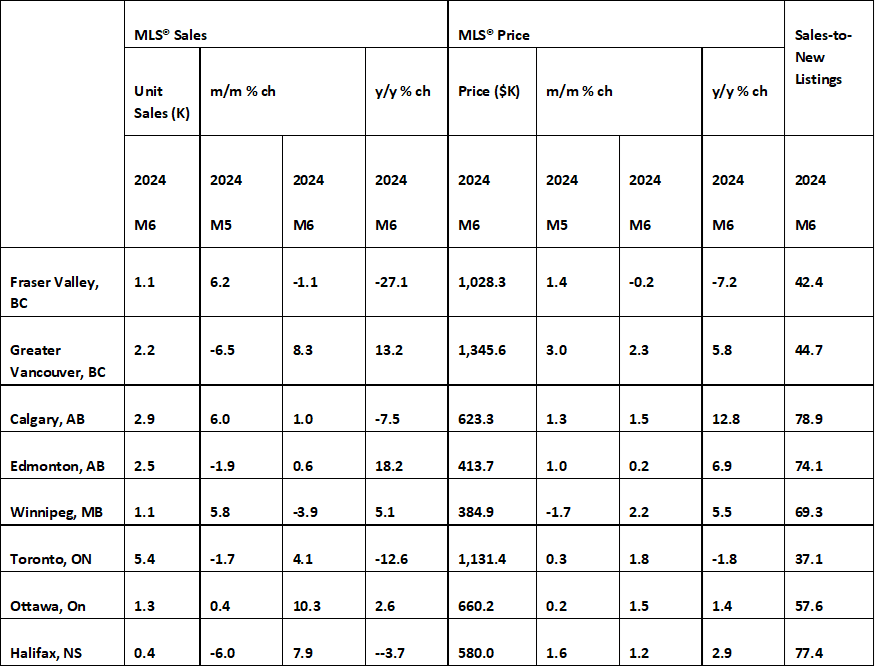

- Home sales in Canada rose in June (3.7 percent m/m) along with the average price (1.5 percent). The tables below summarized the key data points.

Existing home sales rose by 3.7 percent m/m (seasonally adjusted) in June and remained at the lower end of seasonal norm. While early indications from local real estate boards suggested weakness across a few major centers, we saw gains on a national basis. The upturn in sales may be in part due to some buyers seeing the first rate cut by the Bank of Canada a signal to get off the sidelines.

Listings continue to increase but we also saw an increase in the sales-to-new-listing ratio and with it an inching up in house prices. While there was a slight increase in average prices, they are down about 13 percent from the peak of early 2022. Nationally, inventories are down to 4.2 percent from 4.3 percent in May, but are still at higher levels compared to pre-pandemic numbers.

While sales remain weak, the latest data points to some early momentum in the market. With more than 2 million newcomers to Canada in recent years, there are plenty of new homebuyers waiting to move from renting to owning. We expect that sales activity will pick up more rapidly by the fourth quarter, but affordability will remain the biggest challenge to home ownership. While home prices in 2024 remain steady, we expect to see more upward movement in prices in 2025 as the undersupply of housing remains a key driver of the housing market.

Housing Affordability Watch

CMI monitors the latest developments and offers insights on solutions to Canada’s housing affordability crisis

Accessory Dwelling Units (ADUs) are small, self-contained residential units built on existing properties, such as detached backyard cottages or converted garages. These units offer a practical solution to Canada’s housing crisis by increasing housing capacity without requiring additional land. Despite challenges such as the need for flexible funding programs, recent initiatives by financial institutions and market regulators in both Canada and the US highlight a growing recognition of ADUs’ potential. The latest Housing Affordability Watch explores these developments, the unique funding challenges ADUs face, and the opportunity for the Canada Mortgage and Housing Corporation (CMHC) to expand its insurance and securitization programs to support the financing of ADUs. Read more here.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.