After a rapid series of hikes that saw the Bank of Canada’s policy interest rate climb from 0.25% to 5.0% over 18 months, the central bank held firm in its last two meetings. Most analysts anticipate that the Bank will maintain its current stance. However, uncertainty over this stance combined with a deceleration in the Canadian economy have caused a slowdown in housing market activity.

Until there are clearer signs of relief from high interest rates, we expect that housing market activity will remain subdued. Recent data shows a decline in sales during October and a reversal of the price increases observed in the spring. Throughout the fall, mortgage rates climbed, influenced by rising bond yields. This pushed more potential buyers to the sidelines and intensified the challenges faced by existing homeowners seeking to renew their mortgages.

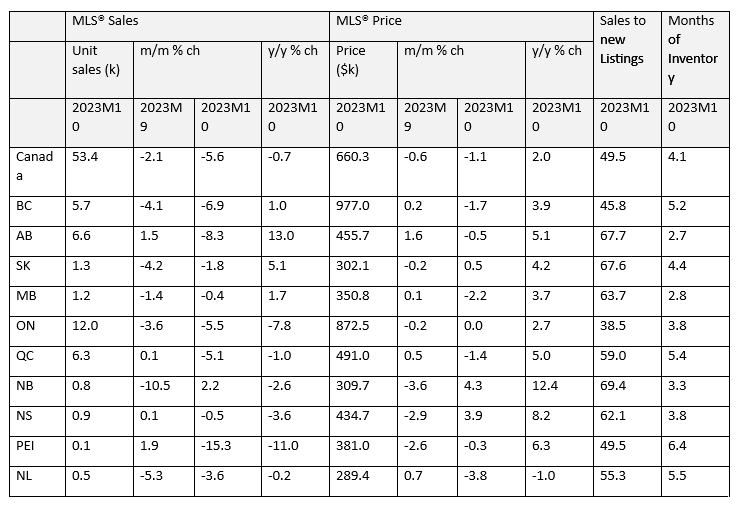

In October, MLS® home sales saw a significant 5.6% drop from September, marking the sharpest monthly decline since June of last year. Monthly sales at 35.4k units fell to the lowest level since March and were down 0.7% from a year ago. The decline in sales was widespread across most provinces in October, with Alberta experiencing the steepest decrease at 8.3%. However, despite this drop, sales in the province remained 13% higher than the previous year. Following closely was a 6.9% decline in British Columbia (B.C.) and 5.0% decreases in both Quebec and Ontario.

At a metropolitan level, B.C.’s Lower Mainland area saw a 10.0% decline, while both Edmonton and Calgary fell 9.0%. Alberta experienced record migration from Ontario and B.C. throughout 2022 and into 2023. This influx drove record condo sales in Calgary during the summer, particularly in July, which spiked by 50% compared to the previous year. Given this context, it’s not surprising this market has cooled. In Ontario’s higher-priced markets where buyers are grappling with affordability challenges, sales activity took a hit, with Toronto experiencing a 5.0% decline and Ottawa facing an 11.0% drop.

Nationally, housing inventory has been growing with declining sales volumes. Listings are sitting on the market for longer than anticipated. There were 4.1 months of inventory on a national basis at the end of October, which is back to pre-pandemic levels. Prices have been falling as a result. In October, the average home price dropped by 1.1% to $660,300, marking the fifth consecutive month of decline. This represents a 7.0% decrease from the peak seen in May and a 17.0% drop from the pandemic peak.

In terms of provincial trends, the most significant monthly price declines were observed in B.C. (1.7%), Newfoundland and Labrador (3.8%), and Manitoba (2.2%). Ontario’s average price remained unchanged, while New Brunswick and Nova Scotia experienced a 4.0% increase. These fluctuations were primarily driven by metropolitan areas. Although average prices can be affected by sales composition, the benchmark value dropped by 0.8%, marking the second consecutive decline.

MLS® Housing Market Summary (October)

Source: CREA

Source: CREA

Housing Affordability Watch

CMI monitors the latest developments and offers insights on solutions to Canada’s housing affordability crisis

A recent Globe and Mail comment piece argued that real estate investors have put upward pressure on prices and crowded out first-time homebuyers. Not so, says CMI president Kevin Fettig in this week’s Housing Affordability Watch. Small-time real estate investors have formed the backbone of Canada’s housing rental market. Their withdrawal would only worsen the existing supply gap. Learn why and what past programs tell us about current solutions to support small investors in expanding rental housing. Read it here: Don’t Count on Tax Incentives for Mom-and-Pop Real Estate Investors.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.