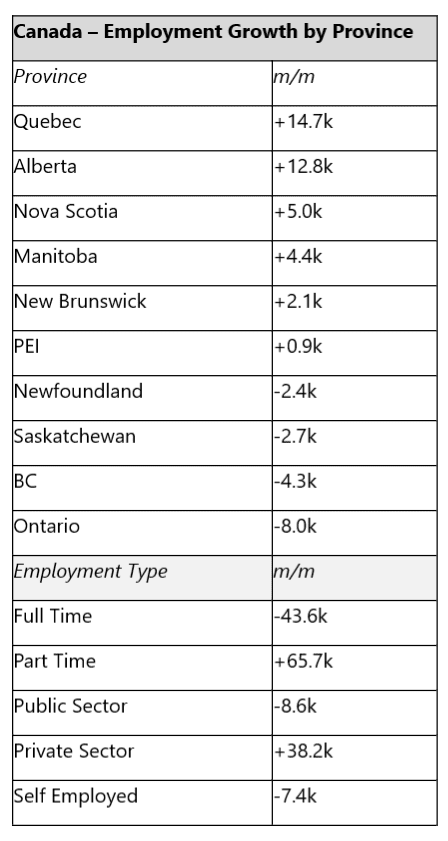

Canada’s labour market added 22,000 jobs in August, roughly in line with expectations, with all gains coming from part-time job positions (+66,000) following losses in July. Full-time employment fell by 44,000.

Labour force growth (+82,500), driven by strong population growth (+96,000), outpaced job gains, pushing the unemployment rate to 6.6 per cent – the highest non-pandemic level since May 2017.

Job gains were concentrated in education services (+1.7 per cent month-on-month, +25,000 jobs), health care and social assistance (+0.9 per cent month-on-month, +25,000 jobs) as well as finance, insurance and real estate (+0.8 per cent month-on-month, +11,000 jobs). However, the gains in health care and education are contradictory to the recent decline in public sector employment and suggest potential sampling errors in this month’s survey.

At 6.6 per cent, the unemployment rate is almost two percentage points higher than its 2022 low of 4.8 per cent. Youth unemployment has risen sharply over the past year, rising by 3.2 percentage points to 14.5 per cent. Job market prospects did not improve much in August, with the student unemployment rate rising to 16.7 per cent – the highest since 2012 – up from 12.9 per cent last summer. This trend is underscored by a decline in the hospitality sector (-10,000). The participation rate is also falling rapidly among those aged 15-24, as a large share of the rapid population growth is driven by students.

Total hours worked declined slightly in August (-0.1 per cent month-on-month) but is up 1.4 per cent over the past year, while wage growth cooled modestly to 5.0 per cent year-on-year in August.

Source: Statistics Canada Labour Force Survey, August 2024

This report highlights ongoing slack in the Canadian economy, specifically in the labour market. The decline in hours worked suggests that overall activity remained subdued in August, following flat GDP results for both June and July. This situation reinforces the downside risk to the Bank of Canada’s Q3 GDP growth forecasts. In its last policy announcement, the Bank highlighted three things: inflation is falling, the labour market continues to slow, and there are downside risks to the inflation. Additionally, there are still concerns about wage growth, which remains elevated despite easing slightly in this report.

Given the risks of a weaker economy, we believe the Bank should consider accelerating the pace of interest rate cuts to get to less restrictive levels. However, that hasn’t been the approach thus far, so we continue to expect 25 basis point reductions until the Bank signals otherwise.

Housing Affordability Watch

CMI monitors the latest developments and offers insights on solutions to Canada’s housing affordability crisis

The federal government has announced plans to lease government-owned land to developers for affordable housing. While the plan seems promising at first glance, a closer look reveals that it is largely a repackaging of existing initiatives – an approach unlikely to deliver the affordable housing the country urgently needs. In our latest Housing Affordability Watch blog, we explore the crucial steps the government must take to make meaningful progress on affordable housing development. Read it here: Affordable Housing – Moving Beyond Press Releases

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.