In December, the Consumer Price Index (CPI) showed a 0.3% increase in inflation, with shelter costs contributing to more than half of this monthly rise. While the CPI is one measure of inflation, the Federal Reserve primarily relies on the price index for personal consumption expenditures (PCE) for its policy setting decisions, and has since 2012. PCE has also been the basis for the Fed’s inflation forecasts since 2000.

However, the rates of inflation calculated by PCE and CPI don’t always align. The current divergence can be explained largely by the different ways these measures account for consumer shelter costs. Notably, rent increases may have a delayed impact on the CPI, which includes two rent measures: rent of primary residence (7.6% of the basket) and owner’s equivalent rent, or OER (25.7% of the basket), representing the implicit rent homeowners would pay if they were renting their homes.

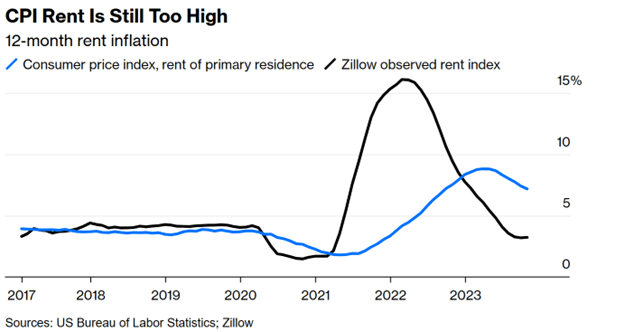

Currently, 35% of the core CPI is based on rents, but CPI estimates are nearly twice what market data providers are reporting, as noted by Bloomberg’s Justin Fox.

Reproduced from Bloomberg

Zillow, the American online real estate marketplace, measures current asking rents, but since the majority of renters are on leases that haven’t yet been renewed, these market rent figures reflect past high rates of rent increases. The Consumer Price Index (CPI) reflects all rents, but changes in rental rates take time to be fully incorporated. Over time, there will be a convergence between CPI rents and market rents.

As of now, rents have increased by 20% since 2020 according to the CPI, while Zillow measures a 28% increase. Bloomerberg’s Fox estimates that it might take until 2026 for these two indices to converge. This discrepancy in housing cost metrics is well-known at the Fed and has been a topic of discussion for over a decade.

In 2020, the Federal Reserve shifted from the Consumer Price Index (CPI) to the Personal Consumption Expenditures (PCE) for its inflation forecasts for several reasons. Firstly, the CPI relies on a relatively fixed basket of goods and services, while the PCE formula adjusts to changing consumption patterns. Secondly, the PCE is revised over time, providing a more consistently tracked series of inflation. Lastly, the PCE encompasses a broader range of goods and services, offering a more comprehensive view of consumer spending than the CPI.

The gap between the two measures is driven by differences in scope and weight. The PCE has a broader scope and incorporates a greater variety of goods and services in its basket compared with the CPI. Variations in the weights assigned to items in each respective basket further contribute to differences between the two indexes. Housing costs, comprising about 15% of the PCE compared to the CPI’s 35%, are less impacted by any lags in rent inflation. As noted by CIBC, this distinction played a crucial role in the Fed’s decision to adjust its forecast for rate cuts this year.

If Fox is right and the lags persist into 2026, we could see a situation where Consumer Price Index (CPI) inflation still seems high while the Federal Reserve asserts that it has effectively tamed inflation. Readers of this note will understand why; hopefully market pundits will, too.

Housing Affordability Watch

CMI monitors the latest developments and offers insights on solutions to Canada’s housing affordability crisis

Accessory Dwelling Unit (ADU) is a broad term that refers to a second residential unit situated on the same lot as an existing primary home. Originating during the Great Depression and reemerging in the 1970s, ADUs have proven essential during housing shortages. Today, they offer a viable response to the current housing crisis, but barriers persist.

In the latest Housing Affordability Watch, we explore the untapped potential of Accessory Dwelling Units (ADUs) and their historical significance as a housing solution. The post delves into challenges, including financing hurdles and bureaucratic complexities. Explore how innovative use of existing housing finance tools, such as the Canada Mortgage and Housing Corporation’s (CMHC) programs, can pave the way for widespread ADU development.

Read the full article here: CMI Housing Affordability Watch: Accessory Dwelling Units (ADUs) – An Essential Housing Solution in Need of a Flexible Funding Program

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.