An ongoing concern for mortgage investors is the ability of consumers to manage their debt. Many Canadians are currently facing challenges due to high debt levels, elevated interest rates, and high inflation. While household incomes and saving rates are higher than pre-pandemic levels, not all households have adjusted equally.

In the coming quarters, financial pressures could worsen for many households as they renew their mortgages at higher rates, despite the Bank of Canada easing its monetary policy stance. What’s crucial for these households is having sufficient disposable income to manage and repay their debt.

Here is a recap of the factors mortgage investors should keep on their radar.

Rent prices

In 2023, the lowest income quintile spent over 18% of their income on interest payments, while the highest income quintile spent around 6%. The lower-income group likely carries more credit card or unsecured debt rather than mortgage debt; however, they are also likely facing larger expenditures for rent. In May, rental inflation was 8.6%, the highest since 1983. Rentals.ca reported that asking rents for residential properties averaged $2,185 in June, marking the slowest annual growth in 13 months, with year-over-year declines in Toronto and Vancouver.

Despite early signs of easing, high rents remain challenging for low-income renters. For mortgage lenders, arrears on loans for rental properties might indicate tenant issues. Given the low vacancy rates, rental issues are likely temporary but it is a factor that should be monitored.

Renewal payment shock

The risk of mortgage borrowers facing higher rates in the future is a significant concern, particularly as tens of thousands of homeowners will need to renew their mortgages over the next two years. Analysts typically focus on the payment shock these borrowers will experience when their mortgages reset. However, most borrowers are not facing their first rate reset—they will renew their mortgage five or more times over a 25-year amortization period. Many have already dealt with rates higher than the pandemic lows. For these borrowers, the flexibility of their household budgets is crucial. RBC’s tracking of credit card expenditure data shows that per-capita consumer spending is declining, with reductions in large discretionary expenses like travel and home renovations. The borrowers under the most pressure are likely to be first-time homebuyers facing their first renewal.

Credit card debt

Another important aspect of household debt is the growth of credit card debt. Nearly 90% of Canadian adults have credit cards, and about half of them pay off their balances in full each month. A recent Bank of Canada report examined credit card debt and the associated risk of financial stress. Based on credit bureau data, the report found:

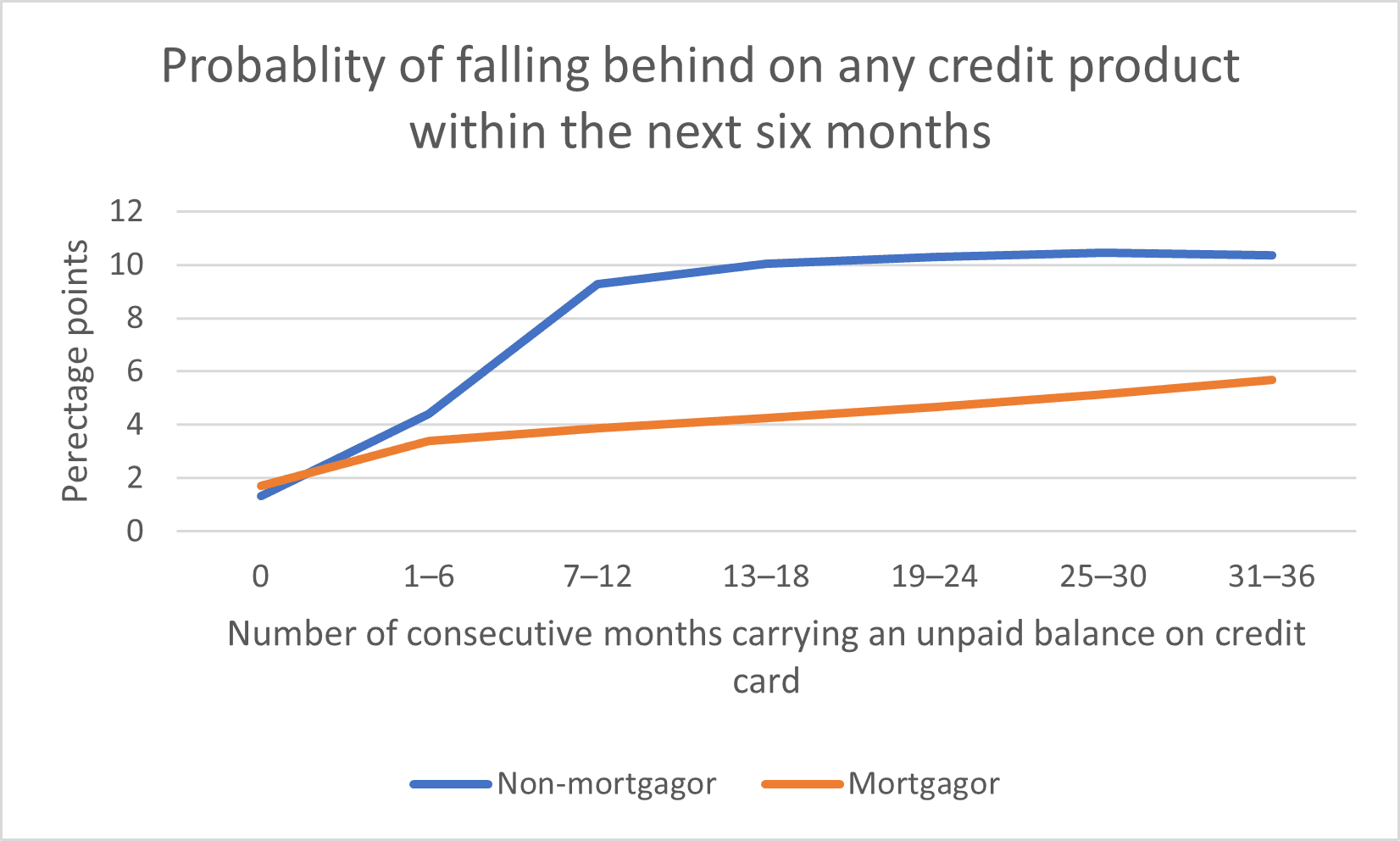

- Financial stress indicators: Individuals without a mortgage (non-mortgagors) who carry a credit card balance are five times more likely to miss future debt payments compared to those who pay off their balances in full each month. Similarly, mortgage holders (mortgagors) who carry a balance on their credit card are more than twice as likely to fall into arrears on their debt within six months than those who pay their balance off in full.

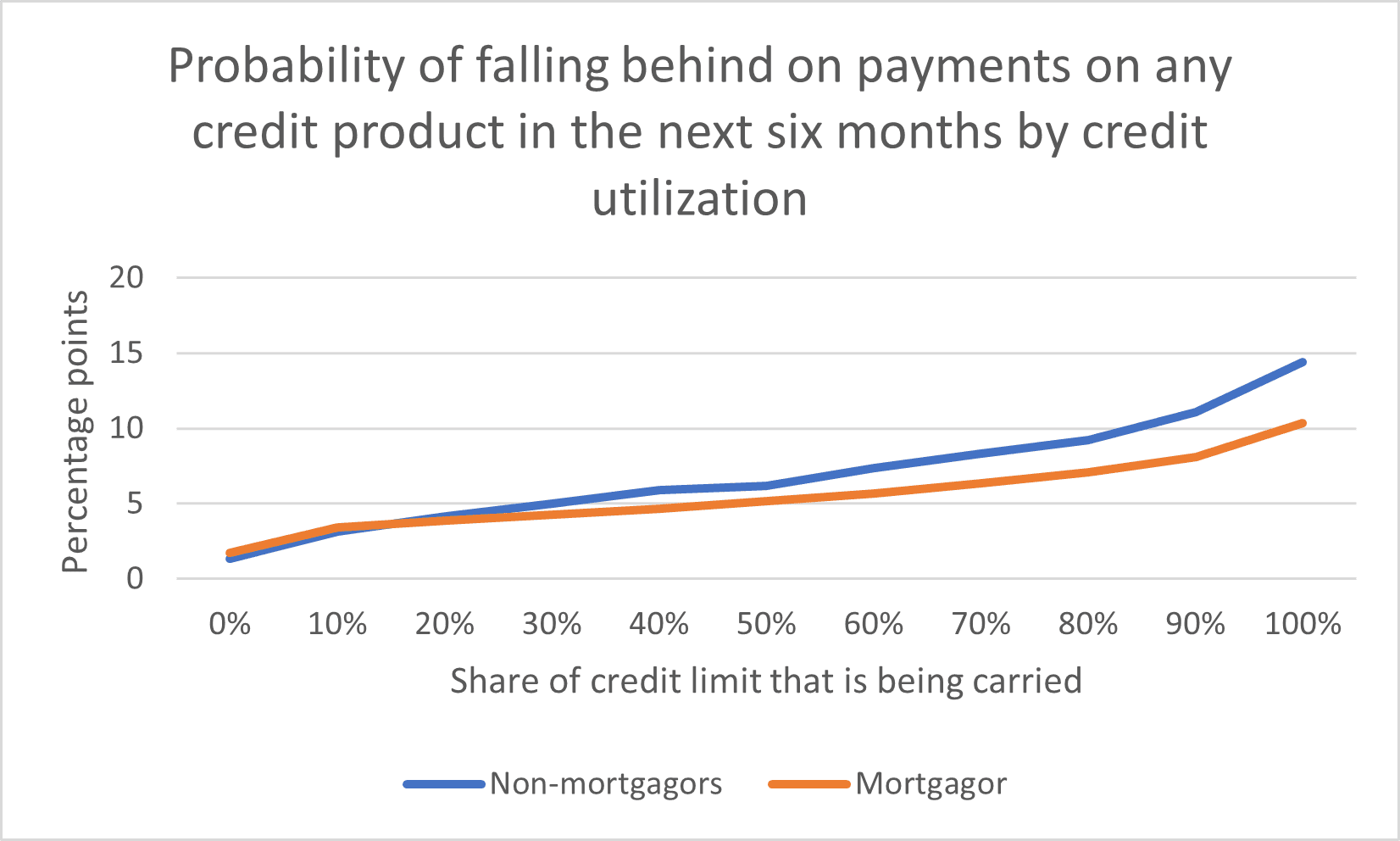

- Impact of long-term balances: Carrying a credit card balance for over six months and reaching high credit utilization rates (using a large portion of your credit limit) are strong predictors of financial stress. These factors significantly increase the likelihood of missed payments and further debt accumulation.

Source: Bank of Canada

- Credit utilization threshold: High credit utilization, often exceeding 75% of the available limit, is a critical threshold. Exceeding this limit correlates with higher financial distress and a greater chance of defaulting on debt.

Source: Bank of Canada

Although mortgage borrowers generally prioritize their mortgage payments over unsecured debt, this remains an important risk factor to monitor.

In summary, monitoring consumer debt trends is crucial for mortgage investors as they navigate a landscape marked by high debt levels, elevated interest rates, and inflation. As homeowners prepare for mortgage renewals in the coming years, the potential for payment shock remains a key concern, especially for first-time buyers. Monitoring and understanding broader debt dynamics is essential for managing risks and making informed investment decisions.

Housing Affordability Watch

CMI monitors the latest developments and offers insights on solutions to Canada’s housing affordability crisis

In June 2024, the benchmark home price in the Greater Toronto Area hit $1,110,600, largely due to land costs. While using government-owned land for low-income housing could help, Canada’s tax system also significantly impacts affordability.

The tax burden on new homes in Ontario is 31% of the purchase price, double the national average. Much of this comes from municipal development charges, which can account for up to 20% of residential project costs. These high fees are under scrutiny, especially given municipalities’ large reserve funds.

The key issue is who actually bears these costs. While developers or landowners might theoretically absorb the fees, it is often new homebuyers who end up paying them. This drives up prices for both new and existing homes. To improve affordability, alternatives should be considered, as current practices and political measures like foreign buyer’s taxes do not address the root issues.

To learn more about potential alternatives and the complex relationship between Canada’s tax system and housing affordability, read the latest Housing Affordability Watch here: Are we Plucking the Wrong Goose?

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.