An improving jobs market, higher oil prices and stronger exports all suggest the Canadian economy is on the gradual road to recovery.

Canada’s economy sprung to life during the holidays, as exports rose and employment surged unexpectedly. Meanwhile, a measure of manufacturing conditions also improved in December, as businesses continued to recover from the fallout from the oil collapse.

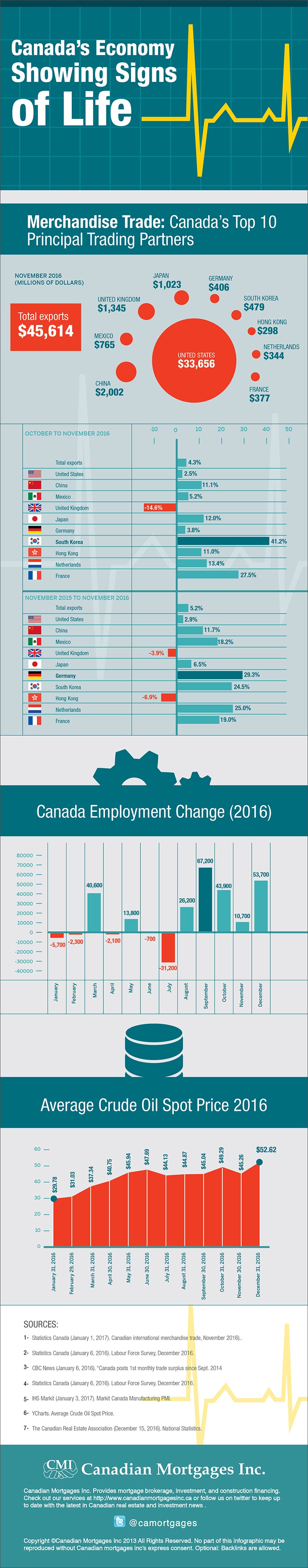

Canada’s Trade Picture Improves

Ottawa posted its first monthly trade surplus in over two years in November on higher mineral exports as well as record shipments to countries other than the United States.[1] The trade balance swung into a surplus of $526 million in November, moving from a $1 billion deficit the previous month. Exports rose 4.3%, outpacing a 0.7% increase in imports.

Shipments to China rose by 11.1% from October. Exports to Japan rose 12% month-on-month, while sales to South Korea surged 41.2%.

Employment Surges Unexpectedly

Canadian employment rose unexpectedly last month, crushing expert forecasts calling for no change. Total employment rose by 54,000 in December, Statistics Canada said. In total, employers added 81,000 full-time positions and laid off 27,000 part-time workers.

Unemployment actually increased last month, as more people searched for work. The unemployment rate crept up to 6.9% from 6.8%. Workforce participation rose to 65.8% from 65.6%.

Employment increased by 108,000 in the fourth quarter, the largest since the second quarter of 2010. Employers added 62,000 jobs in the July-September period. For all of 2016, employment grew by 214,000.[2]

Canadian Manufacturing Ends Year on Stronger Footing

Canada’s manufacturing sector, which accounts for over 10% of the nation’s GDP, ended the year much better than where it started. The Markit Canada manufacturing purchasing managers’ index (PMI) rose 0.3 points to 51.8 in December, as new orders hit two-year highs. A PMI reading above 50 indicates growth.

“Canada’s manufacturing sector ended the year on a much stronger footing than it started, with production volumes and new orders both returning growth territory,” said survey compiler Tim Moore.[3]

Stronger manufacturing output in December was driven mainly by stronger domestic demand from the energy and automotive sectors. Energy producers are benefiting from the latest upturn in oil prices, which extended 18-month highs in the first week of January. Oil prices have gained roughly 20% since OPEC announced its plan to reduce crude output on November 30.

Home Sales Down Across the Country in November

A stronger economy didn’t translate into higher home sales in November, a sign the government’s stress-test on homebuyers with less than a 20% down payment was beginning to weigh. Home sales declined 5.3% in November, the largest monthly decline since August 2012, the Canadian Real Estate Association (CREA) said in December. As a result, the number of homes changing hands fell to the lowest level since September 2015.

“Canadian housing market results for November suggest that Canada’s housing sector is unlikely to be as strong a source for economic growth as compared to before mortgage regulations were recently tightened,” said CREA chief economist Gregory Klump.[4]

Housing generates a lot of spin-off activity for the Canadian economy, and it’s anyone’s guess how stricter lending terms will impact growth in 2017. The Bank of Canada has no intention of raising interest rates any time soon, which could lead to a tug-of-war between Canadian home owners and potential buyers this year.

Sources

[1] CBC News (January 6, 2016). “Canada posts 1st monthly trade surplus since Sept. 2014.”

[2] Statistics Canada (January 6, 2016). Labour Force Survey, December 2016.

[3] IHS Markit (January 3, 2017). Markit Canada Manufacturing PMI.

[4] The Canadian Real Estate Association (December 15, 2016). National Statistics.