There have been huge swings in the US stock market lately, but bond markets have not moved as expected. Typically, treasuries benefit during periods of uncertainty, as investors flock to safer assets. However, last Friday saw falling bond prices pushed the benchmark 10-year Treasury yield briefly above 4.5 per cent up, from 3.99 per cent just a week earlier.

This type of movement is atypical and has largely been attributed to foreign governments and other investors selling their bond holdings. While some have speculated that US treasuries are being offloaded as tariff retaliation or a negotiation tactic – particularly by China, on one of the largest holders – there’s little evidence to support this. It also seems unlikely that governments like Canada or those in the EU would take this step. Large-scale sales by sovereign holders would be highly visible, especially since the NY Federal Reserve acts as custodian for these US dollar-denominated foreign exchange reserves.

A more plausible explanation is that hedge funds have been unwinding large positions in the bond market. Bid-ask spreads widened significantly, which indicates that there was pressure on the market. As reported by Reuters, one trading desk observed spreads at double their typical levels. This type of activity is not without precedent – the New York Fed noted that a similar unwinding of basis trades by hedge funds contributed to the Treasury market stress seen in March 2020.

How leveraged trades are shaping bond market dynamics

There are two main types of leveraged trades in the US bond market: basis trades and swap spread trades. Both involve taking long positions in cash Treasury bonds, while either shorting Treasury futures (basis trade) or interest rate swaps (swap spread trade). These strategies rely heavily on leverage, since the purchase of the Treasury bond (long position) is financed through the repo market. For example, a $100M trade in basis or swap spreads might only require 2 to 5 per cent in hedge fund capital, with the remainder funded through short-term borrowing in the repo market.

Consider the swap spread trade. When the repo market is functioning smoothly, investors can use it to fund purchases of 30-year US Treasuries while simultaneously entering into a fixed 30-year interest rate swap against it. This strategy would earn them 90 basis points per year in ‘’swap spread” returns. With leverage ratios ranging from 20 to 50 times, the potential returns are huge.

This return opportunity is driven by two main factors: a growing supply/demand imbalance in the US Treasury market and the impact of regulation.

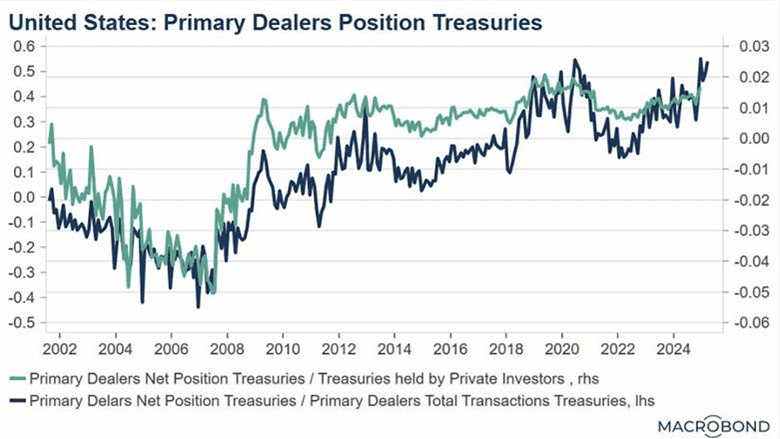

Despite the Federal Reserve’s Standing Repo Facility (SRF) allowing banks to repo Treasuries — exchanging them for cash with an agreement to repurchase later—at par, primary dealers are holding increasingly large inventories of US government debt.

As the chart below illustrates, the ratio of net positions to total dealer transactions has been rising, even as daily trading volume in the Treasury market approaches $1 trillion. This accumulation reflects growing pressure on dealer balance sheets, driven not just by liquidity constraints, but by regulatory capital requirements that limit the amount of risk dealers can take on.

Source: Macrobond

The SRF offers eligible institutions overnight funding secured against Treasuries and other high-quality collateral, with the Fed accepting these securities at face value regardless of market price. This provides a powerful liquidity backstop, effectively protecting banks from forced sales in stressed markets. However, it does not exempt banks from Basel III capital requirements.

Regulations such as the Supplementary Leverage Ratio (SLR), which includes Treasuries in its calculation, discourage banks from holding large inventories of government debt. This limits the market’s capacity to warehouse risk and makes it more difficult for the Treasury to finance deficits efficiently. As a result, market makers have been hamstrung in their ability to act as a liquidity buffer, reducing their capacity to absorb large volumes of Treasuries, especially during times of volatility or increased supply.

The impact of ongoing budget deficits

With persistent budget deficits, the supply of US Treasuries has grown. So far, dealers have been able to take down auctions (purchase the full amount of Treasuries offered) without concerns about coverage (ensuring there is sufficient demand to absorb them). However, this supply/demand imbalance has led to leveraged hedge funds becoming the marginal buyers of US treasuries, with these funds demanding a large premium to participate.

In recent weeks, several funds were hit with margin calls due to market turbulence. To meet these margin requirements, some funds were forced to de-risk their portfolios, including their holdings of Treasuries. As a result, Treasuries got caught up in portfolio deleveraging, with basis trades and swap spread trades taking a hit. This has led to an unwind across these same trade strategies.

The challenge for the Treasury market going forward is the large US deficit, which is projected to hit $1.9 trillion in FY2025, with total debt around $36 trillion. This creates an opportunity for oversized bets by bond traders and fund managers. However, during periods of volatility, the available liquidity to absorb these Treasury flows is often insufficient, causing rates to rise quickly. Unless there are regulatory changes to allow for greater liquidity buffers in the US bond market, we can expect Treasury yields to continue experiencing this level of volatility, especially amid ongoing uncertainty and ever changing policy.

Housing Affordability Watch

CMI monitors the latest developments and offers insights on solutions to Canada’s housing affordability crisis

Last week, we looked at the Liberal’s affordable housing plan. This week, we turn our attention to the Conservative platform.

From cutting the GST on new homes to using federal land for housing, the Conservative plan shares some similarities with the Liberal platform but takes a different approach in several key areas. What are the potential benefits and challenges, and does the plan go far enough to drive meaningful change?

In the latest Housing Affordability Watch, we dig into the details. Read it here: The Conservative Housing Plan – The Difference is in the Details

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.