Featured

Featured

What does a mortgage broker do? Your step-by-step guide

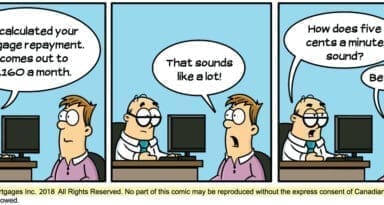

Dealing with banks can be super stressful when refinancing your mortgage, getting a new one, or accessing the equity in your home. So, it’s only natural you’ll want a team of trusted professionals on your side. Hiring an expert r[…]

Read more

3 tactics to a successful mortgage refinancing in Canada

You’ve probably heard the term “mortgage refinancing” tossed around like salad, but do you truly understand what it means? Mortgage refinancing is when you replace your existing mortgage on your property with a new mortgage with different[…]

Read more

Finding the right mortgage broker in Vancouver

A mortgage broker is supposed to work on your behalf to secure the mortgage financing you’re looking for when purchasing a property, renewing your mortgage or refinancing your mortgage. Your broker plays an important role in the home-buying process. He should assess your finances and help present you with the mortgage financing option best suited to your needs.

Read more

HELOC vs mortgage: Everything you need to know

There are approximately 3 million HELOC accounts in Canada with an average outstanding balance of $70,000—and many Canadians with a HELOC can expect their borrowing cost to increase this year with rising interest rates looming.

Mortgages, on the other hand, are obviously much more wi[…]

Read moreContact Us

Contact us today to set up an appointment.