Canada is not alone in facing affordability challenges. Sweden, Norway, Australia, New Zealand and, more recently, the US are also grappling with a housing crisis.

The average price of an Australian home has surpassed A$1m for the first time, highlighting the nation’s struggle with affordability. According to estimates released by the Australian Bureau of Statistics in June, the average home was worth A$1,002,500 in the March quarter, up 0.7 per cent from the previous quarter. Similar to Canada, key drivers of the crisis include a shortage of housing supply, a growing population, heightened investor activity, and inadequate investment in social housing.

Australia’s federal response to the housing affordability crisis includes initiatives to boost housing supply, such as the Housing Australia Future Fund and Housing Support Program, while also expanding home ownership opportunities through schemes like Help to Buy. Additional measures include providing financial assistance for renters through Commonwealth Rent Assistance and implementing the National Planning Reform Blueprint to streamline approvals.

Unlike Canada, where the strategy has primarily focused on increasing supply in the rental market, Australia has also focused on ways to help people enter the home ownership market sooner, including through the Home Guarantee Scheme.

This note outlines key features of the scheme. Next week, we’ll examine some of the policy issues around its design and whether a similar program would make sense in Canada.

Australia’s Home Guarantee Scheme

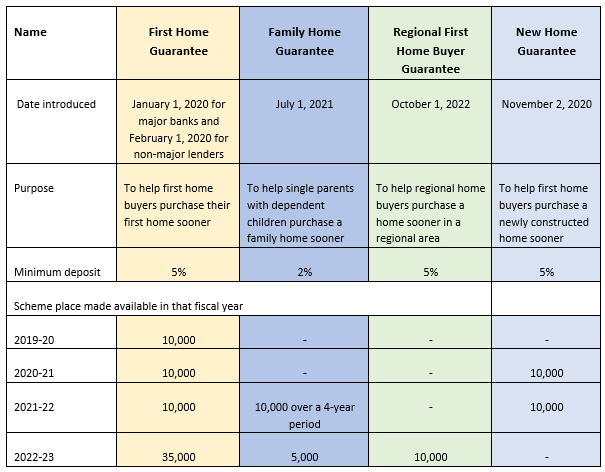

In the early part of the decade, the Australian government launched four related programs under the Home Guarantee Scheme to support different types of buyers:

Source: NHFIC

On July 1, 2022, the First Home Buyer Guarantee (FHBG), New Home Guarantee (NHG) and Family Home Guarantee (FHG) were brought under the new banner of the Home Guarantee Scheme. The Regional First Home Buyer Guarantee (RFHBG) was launched under the Scheme on October 1, 2022.

During 2022–23, 50,000 places were available to eligible home buyers across the FHBG, FHG and RFHBG programs. The NHG closed to new applications on June 30, 2022.

In April 2023, the government announced an expansion of the scheme’s eligibility criteria. From July 1, 2023, the scheme opened to eligible permanent residents as well as Australian citizens, non-first home buyers who have not owned a property in the past 10 years, and any two applicants broadly (including friends, siblings or other family members), as well as married or de facto couples. The FHG was also expanded to include eligible single legal guardians with at least one dependent child, as well as eligible single parents.

The scheme allows borrowers to put down as little as 5 per cent for a down payment. The government guarantee replaces the need for Lenders Mortgage Insurance (LMI), the Australian version of mortgage insurance. For the average first-time buyer, access to the program can reduce the time needed to save for a down payment by several years and save tens of thousands of dollars in mortgage insurance costs.

The scheme has had a significant impact on the first-time home buyer market. According to Australia’s National Housing Finance and Investment Corporation, “close to 1 in 3 of all first home buyers in 2022–23 were supported by the scheme. This is a significant increase from 2021–22, when the Scheme supported 1 in 7 first home buyers.”

The program placed caps on property values for different markets and set income limits to target this as an affordability program. More recently, the Albanese government announced that the program would be expanded to all first-time home buyers starting October 1, 2025. These buyers will have access with no caps on location or income limits. Prior to this, the caps restricted eligibility to individuals with a taxable income of up to A$125,000 and joint applicants with a combined income of A$200,000 in the prior financial year. Income limits are determined from the borrower’s Notice of Assessment issued by the Australian Tax Office.

Property price caps will also be raised in line with average house prices, providing access to a wider variety of homes. The cap in Sydney and regional New South Wales will increase to A$1.5 million, while Melbourne and regional Victoria’s cap will increase to A$950,000. In addition, the program will no longer limit the number of places available. With this change, the Regional First Home Buyer Guarantee (RFHBG) program is being rolled into the Home Guarantee Scheme.

The government is also expanding the program to include smaller, customer-owned and regional bank lenders. It is currently available through more than 30 participating lenders across Australia.

While it’s too early to evaluate the program, our next note will examine its potential impact on the Australian mortgage insurance industry, implications for mortgage brokers, the government’s exposure as guarantor, and likely effects on house prices. Finally, we’ll discuss whether a similar program would make sense in Canada.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.