Housing was one of the only bright spots in an otherwise ugly second quarter for Canada’s economy.

Consumer spending and demand for housing were the main positive contributors to the Canadian economy in the second quarter, as Alberta’s wildfires led to the worst decline in GDP since the Great Recession.

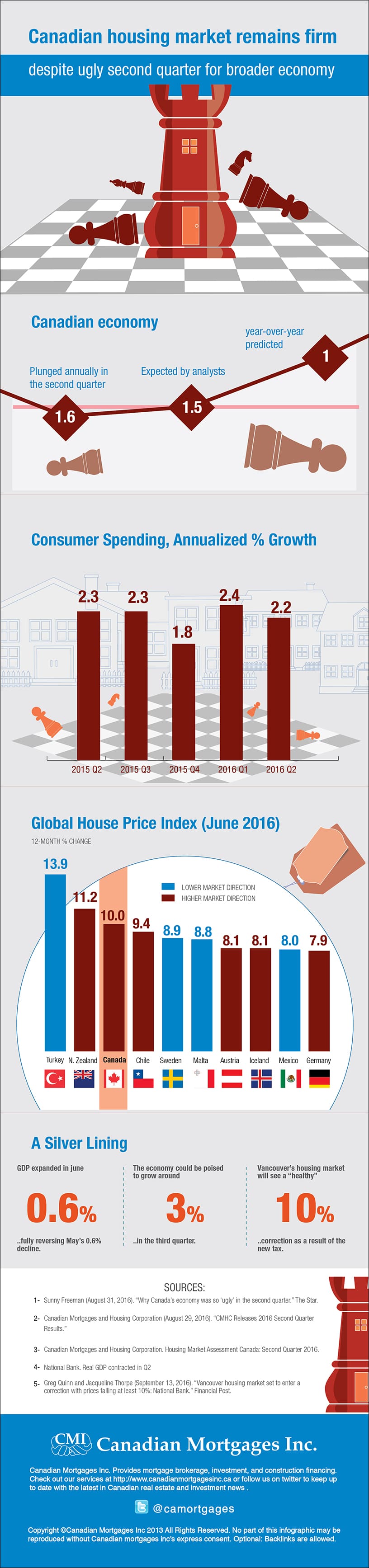

The Canadian economy plunged 1.6% annually in the second quarter, slightly worse than the 1.5% drop analysts were expecting. It was also much worse than the 1% year-over-year decline predicted by the Bank of Canada (BOC) back in June.[1]

Consumer Spending Keeps Humming Along

Yet, Canadian consumers continued to spend money, with household spending climbing 2.2% from the previous quarter. Based on the latest quarterly report from the Canadian Mortgage and Housing Corporation (CMHC), we can assume that a sizable chunk of consumer outlays went toward housing-related expenses. That’s because the CMHC provided loan insurance for 134,891 units across Canada in the second quarter, up 11.2% from the same period a year ago (see infographic).

By the end of the second quarter, CMHC’s mortgage insurance business was a massive $523 billion in total insurance-in-force. The CMHC’s ceiling for total insurance-in-force is $600 billion.[2]

CMHC Acknowledges That House Prices Are Inflated

The CMHC recently admitted that national house prices are overvalued when compared to disposable incomes and population growth, but it stopped short of admitting there was a major problem.

“Overheating and acceleration in house prices are not a concern at this time,” the CMHC said in its second quarter Housing Market Assessment.[3]

Of course, many experts strongly disagree with the CMHC. UK-based real estate consultancy Knight Frank recently revealed that Canadian housing prices are growing faster than all but two countries. The Global House Price Index shows Canadian real estate prices surged 10% year-over-year in June, surpassed only by Turkey (13.9%) and New Zealand (11.2%). The global average was just a 4% increase. The Global House Price Index in the infographic has more.

Canadian incomes have increased in three consecutive quarters and in nine of the last ten quarters,[4] but the pace has been nowhere near what we’ve seen in the housing market. This once again leads us back to the debate about Canadian household debt, which remains the highest in the G7.

A Silver Lining

The Canadian economy certainly ended on a high note in the second quarter, raising optimism that the recovery will get back on track soon enough. GDP expanded 0.6% in June, fully reversing May’s 0.6% decline. The recovery is expected to continue as more energy producers get back online in Alberta. With a strong handoff from June, the economy could be poised to grow around 3% in the third quarter.

Market analysts will continue to monitor developments in the housing market, including an anticipated correction in Vancouver after the BC government set a 15% tax on foreign home buyers in the region. According to National Bank, Vancouver’s housing market will see a “healthy” 10% correction as a result of the new tax.[5]

References

[1] Sunny Freeman (August 31, 2016). “Why Canada’s economy was so ‘ugly’ in the second quarter.” The Star.

[2] Canadian Mortgages and Housing Corporation (August 29, 2016). “CMHC Releases 2016 Second Quarter Results.”

[3] Canadian Mortgages and Housing Corporation. Housing Market Assessment Canada: Second Quarter 2016.

[4] National Bank. Real GDP contracted in Q2.

[5] Greg Quinn and Jacqueline Thorpe (September 13, 2016). “Vancouver housing market set to enter a correction with prices falling at least 10%: National Bank.” Financial Post.