The June labour report delivered an encouraging sign that Canadian businesses and the economy have remained resilient amidst early-year trade uncertainty. Employment rose by 83,100 jobs – significantly higher than the market expected. The only weak spot was that most of the gains came from part-time positions.

While the country recorded a strong hiring gain, labour market conditions remain soft. The unemployment rate nudged lower to 6.9 per cent in June, but it remains elevated at its highest level since 2021. Slower population growth has helped contain growth in the jobless rate.

The Bank of Canada will be examining the latest CPI inflation data closely ahead of its next interest rate decision. It will also need to assess the risk from the evolving trade environment, including Trump’s latest threat – one of many directed at US trading partners – of a 35 per cent tariff on Canadian goods starting August 1. While that could further dampen business sentiment and exports, June’s stronger employment numbers give the Bank room to stay on hold.

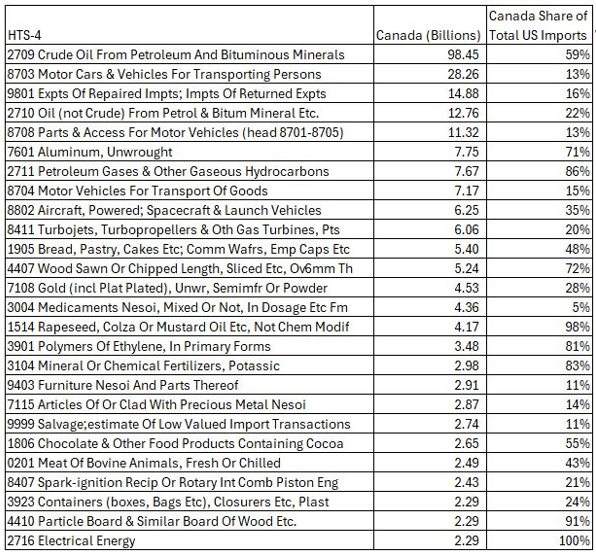

Trade remains the biggest source of uncertainty. Over the weekend, the President described the US trade deficit as a risk to national security in a social media post. The table below, from Jason Miller, Professor of Supply Chain Management at Michigan State University, shows US imports from Canada and Canada’s share of total US imports.

Source: Jason Miller, Michigan State University

While it’s likely that CUSMA will continue to apply and that energy products will be exempt due to concerns over rising energy costs, significant impacts are still expected. Market segments such as heavy trucks, aerospace, agricultural goods and lumber are likely to be among the hardest hit.

We expect the US will end the year with an effective tariff rate around 15 per cent. While the Supreme Court is likely to rule the tariffs imposed under the International Emergency Economic Powers Act (IEEPA) unlawful, that decision is unlikely to come until early next year. In the meantime, these tariffs will continue to be a drag on the steel, aluminum and copper industries.

We believe the Trump administration is using the latest round of tariff escalations to maximize its negotiating leverage. The key question will be how much flexibility we have on contentious trade irritants, such as Canada’s supply management system, and whether there will be a foundation for a new trade deal in August. Until then, expect more uncertainty – and for the Bank of Canada to remain on the sidelines until there is greater clarity on trade policy.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.