China and the United States have agreed to lower tariffs on goods from each other’s countries for 90 days, offering a temporary reprieve in a trade war that threatens to cause a global recession and deepen a widening rift between the world’s two largest economies.

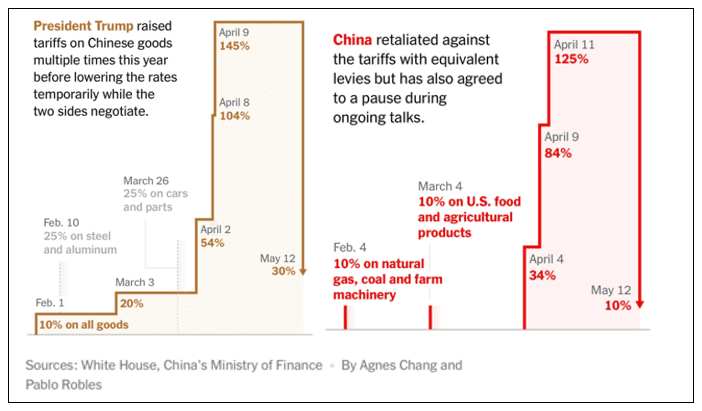

As shown in this chart from the New York Times, these tariffs quickly escalated to levels that threatened to halt trade altogether. This recent move offers only a temporary reprieve and still leaves uncertainty for firms placing orders for future delivery. While we won’t see US store shelves go empty, businesses are likely to proceed with caution.

Tit-for-tat tariffs between the US and China

Examples from the UK and China suggest that the 10 per cent universal tariff rate applied by the US on imports is not going away anytime soon. Sector-specific tariffs also remain an issue. These Section 232 tariffs currently apply globally at a rate of 25 per cent on steel, aluminum, products made from these metals, automobiles, and auto parts. With the 232 lists set to expand, negotiations around the future application of new tariffs – including their scope and rates – should be prioritized in discussion agendas.

It’s also worth noting that the current 10 per cent tariffs are much higher than the roughly 2 per cent average that existed in early January – a bottom-line difference that matters to both businesses and households.

We are beginning to see data that sheds light on the potential impacts of a full-on trade war. So far, the results are mixed. US employment data remains strong, and the ISM Services PMI, which measures activity in the services sector, rose unexpectedly in April to 51.6. However, despite improvement in the overall index, business activity declined. Most survey respondents reported operational and pricing challenges resulting from tariffs.

In its post-FOMC statement last week, the Fed warned of upside risks to both unemployment and inflation. The latest Blue Chip survey – a monthly consensus forecast from leading private sector economists – now expects just 1.2 per cent GDP growth this year, down a full point since the start of the year, while unemployment is projected to climb to 4.4 per cent and inflation is expected to edge up to 3.2 per cent. These developments have constrained the Fed from pursuing further rate cuts.

In balancing its dual mandate, the Fed may soon be forced to decide which aspect takes precedence – stable prices or maximum employment. That’s what makes stagflation its worst nightmare – the prospect of having to raise interest rates to restrain inflation even as unemployment rises, or to cut rates to support jobs and avoid a recession despite rising inflation. This dilemma has made the Fed more cautious about its next move, but markets are now expecting the next rate cut at the July 30th FOMC meeting.

Canadian data shows the economy is holding up but starting to take some hits from rising tariffs and ongoing uncertainty around the timing and scope of any policy resolution. Employment showed a modest gain of 7,400 jobs, largely supported by a 37,100 increase in public sector hiring – much of which was likely due to election-related jobs. Excluding that temporary boost, Canada has seen back-to-back declines of around 30,000 jobs, primarily in the manufacturing sector. Meanwhile, continuing uncertainty has kept the housing market dormant. This backdrop positions the Bank of Canada to consider further rate cuts, with its next meeting in early June a possible option.

Housing Affordability Watch

CMI monitors the latest developments and offers insights on solutions to Canada’s housing affordability crisis

After decades of challenges with rental housing policy, the government is considering reviving the Multi-Unit Residential Building (MURB) program. But to truly make an impact, significant changes may be needed. In our latest analysis, we explore the program’s previous shortcomings and what could be done differently now to improve the long-term economics of rental real estate investing.

Read our latest Housing Affordability Watch here: Revitalizing the MURB Program – What Past Mistakes Can Teach Us

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.