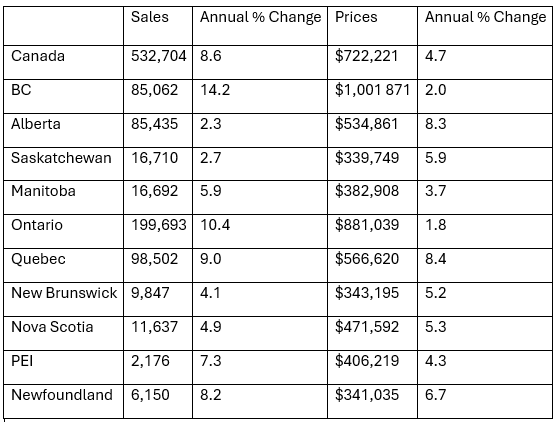

CREA recently released its updated forecast for home sales activity and average home prices for 2025 and 2026. It projects that two-and-a-half years of pent-up demand, coupled with lower borrowing rates, will drive a rebound in the housing market.

However, this recovery is expected to play out differently across regions. In BC and Ontario, sales are expected to rebound the most, given current low sales levels and higher inventories. This could create some potential for price increases; however, due to affordability challenges, price gains are expected to be more modest compared to other parts of the country.

Alberta and Saskatchewan, which have already seen an increase in sales, will see slower sales growth, but prices are expected to rise more significantly due to inventories being at near 20-year lows.

Manitoba, Quebec and the Atlantic provinces will likely fall somewhere in between, with more sales and higher prices expected in 2025.

CREA 2005 Forecast

Source: Canadian Real Estate Association (CREA)

The Bank of Montreal’s January housing monitor largely aligns with CREA’s outlook. It notes that major urban centers in the Prairies are sellers’ markets and are expected to continue outperforming the national average in price growth. Quebec and Atlantic regions are experiencing tight markets, with sales outpacing listings. BC is struggling somewhat with the benchmark price about 4 per cent below its last market peak.

Where BMO is less optimistic is in their view of Ontario. Toronto is the last remaining buyer’s market among the major cities it tracks. The glut of condos hitting the resale market has been a weak point for the national real estate market, with prices down 3.7 per cent year-over-year in that segment. BMO anticipates that much of Southern Ontario will continue to be a relatively soft market.

While the housing narrative used to be a tale of two markets, with a focus on a divide between BC and Ontario versus the rest of Canada, it has now shifted to Toronto versus the rest of Canada.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.