In June 2022, CMHC estimated that Canada needs to build 5.8 million housing units by 2030 to restore housing affordability. The current pace of construction is not anywhere near this level, and there are signs we could see a falloff in condominium construction. The industry has focused on delivering smaller units that met the needs of small investors, but has fallen short in delivering units that align with the needs of first time homebuyers. With new units priced at levels well above the existing stock, an adjustment process can be expected. In Toronto, a high level of condominium completions has created an inventory overhang, while Vancouver faces a challenging, albeit slightly better, outlook. As a result, we expect condominium starts will be suppressed in these markets for up to a year as inventory levels normalize.

More broadly, while housing starts are positive, the numbers are well below the levels needed to meet CMHC’s goals.

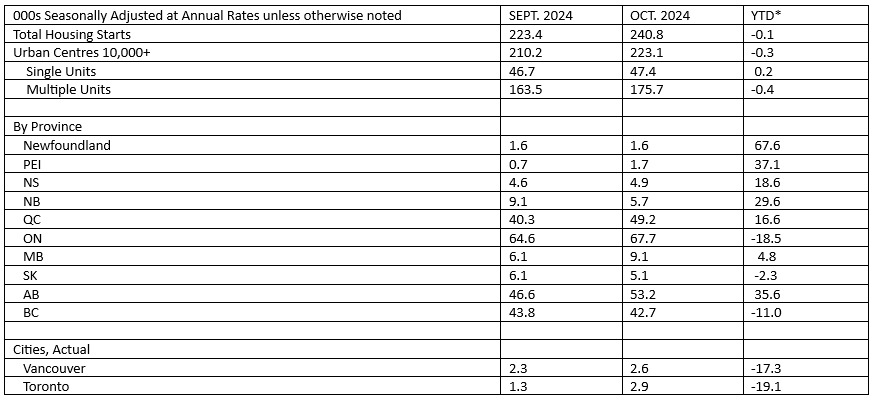

Housing Starts, October 2024

*% change, January to October 2024 versus January to October 2023 Source: CMHC

Housing starts picked up slightly in October to 240,000 units, but remained below the year-to-date average of 244,000. The increase in October was a modest improvement over August and September, which averaged 220,000 units. Given the volatility in this data, particularly for multifamily starts, this should not be viewed as real improvement in construction activity.

In Ontario, housing starts increased on a seasonally adjusted annualized basis by 64,605 units, a 5.4 per cent rise from the previous month. However, this figure was far below the monthly average for the year of 74,114 units, making it the third-lowest monthly rate this year. Multifamily dwelling starts rose by 7.6 per cent to 49,257 units, while single detached homes were down 1.1 per cent to 15,348 units. Of Ontario’s 16 metro areas, seven recorded an increase in housing starts during October.

Housing starts in BC saw a slight decline in October. On a seasonally adjusted annualized basis, the province recorded 40,487 housing starts for the month, nearly unchanged from September’s 40,580 units, but slightly below this year’s monthly average of 42,666 units. Multifamily unit starts fell 0.9 per cent to 35,907 units, while single family units were up 5.8 per cent to 4,580 units. Of BC’s seven metro areas, three recorded an increase in housing starts for the month.

The latest Canadian Home Builders Association survey highlights the poor sentiment in the industry, with builders expressing concern that falling interest rates alone are not sufficient to restore affordability. The industry is challenged by construction labour shortages, high building material costs and an aging workforce. The Building Industry and Land Development Association (BILD) has been highlighting that high government fees, which account for 25 per cent of the cost of the average GTA home, are a significant barrier to affordability.

These cost pressures have contributed to a rise in property developers filing for receiverships. According to the Office of the Superintendent of Bankruptcy, there were 256 bankruptcies and proposals in the real estate, rental, leasing and construction sectors under the Bankruptcy and Insolvency Act in Q3 2024, up from 199 in Q3 2023—an increase of 29 per cent.

Any overhang of unsold condominium projects will prompt banks to be more cautious in their lending. We should expect to see a slowdown in condominium development in Toronto and Vancouver until excess inventory is absorbed. As a result, the multifamily housing space will become even more reliant on government funding through programs like the Apartment Construction Loan Program.

Until governments reduce their fees and charges on housing, the housing crisis will not be solved.

Housing Affordability Watch

CMI monitors the latest developments and offers insights on solutions to Canada’s housing affordability crisis

The evolution of the Canadian mortgage market is a complex narrative, influenced by shifting economic conditions, policy reforms, and legislative changes. These factors have combined to shape the diverse and dynamic mortgage landscape we recognize today.

In the first installment of our two-part series, CMI’s Kevin Fettig draws on his experience with the Bank of Canada and CMHC to explore this rich history, focusing on the changing roles of key market players and the pivotal legislative shifts that allowed chartered banks to dominate the mortgage industry.

Read more in our latest Housing Affordability Watch: The Evolution of the Canadian Mortgage Market: A Brief History – Part 1

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.