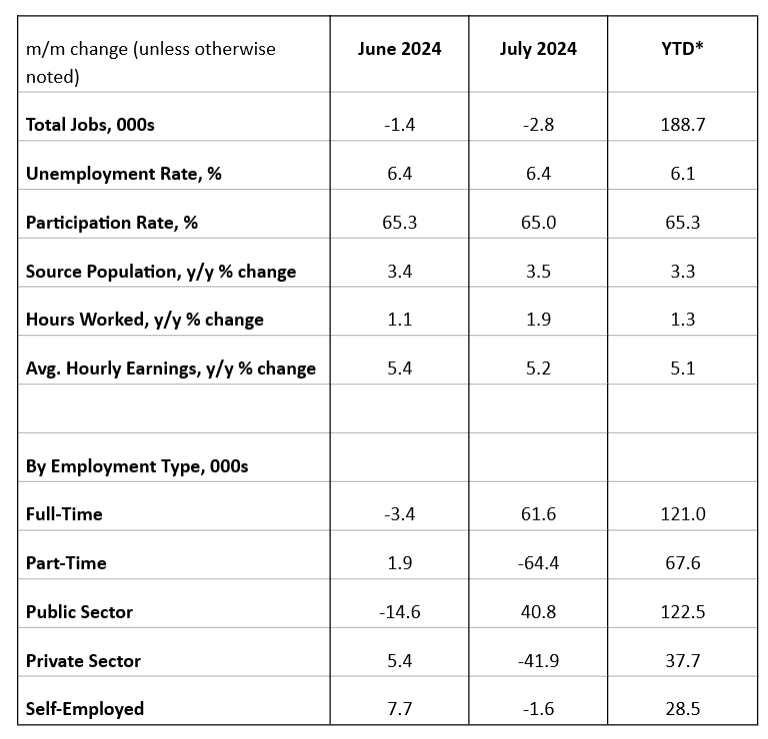

In July, Canadian employment slid by 2,800, adding to the decline in June. Despite the drop, the unemployment rate held steady at 6.4% due to a significant month-over-month decline of 0.3% in the participation rate. If the participation rate had remained unchanged, the increase in population would have pushed the unemployment rate to 6.7%. Full-time jobs were up a notable 61,600, while private sector employment declined by 41,900. This decline was almost completely offset by public sector gains of 40,800.

While the overall unemployment rate was unchanged, the youth (15-24) rate was up to 14.2%. Ignoring the pandemic period, this is the highest youth unemployment rate since 2012. This has been one of the worst summer job markets since the recession of 2009.

Regionally, employment increased in Ontario (+22,000) and Saskatchewan (+7,000), while British Columbia (-10,000) and Quebec (-9,000) experienced the largest declines. This narrowing geographic diffusion of employment is something to keep an eye on. Limited employment gains concentrated in only a few provinces is a concerning trend.

Permanent wage growth remains well above the pace of inflation, although other compensation measures are growing at a more moderate pace. Wage growth is rising due to government hiring, and the growth in average hourly earnings reflects the disproportionate gains in public sector employment.

Despite some lingering upside risk to inflation, we expect the Bank of Canada will lower its policy rate in September. The labour market is softening, and we expect this trend to continue in the months ahead, which should ease price pressures further. The only factor that might prevent a rate cut in September is the upcoming Consumer Price Index (CPI) report on September 20. If core inflation pressures ease, it should be an easy decision for the Bank to move rates lower.

Labour Force Survey, July 2024

*January to July 2024 average for participation and unemployment rates, y/y growth rates

Source: Source: Statistic Canada — Labour Force Survey, July 2024

Housing Affordability Watch

CMI monitors the latest developments and offers insights on solutions to Canada’s housing affordability crisis

CMHC’s increased mortgage loan insurance premium rates for multi-unit properties, implemented last June, might seem minor at first glance, but the potential impact on affordable housing projects is significant. In the latest edition of Housing Affordability Watch, we delve into alternative risk transfer mechanisms that could improve capital allocation within the housing finance system and how these changes might influence the viability of affordable housing. Get the full take here: Letting Go of Risk

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.